Tips for Reducing Commission Drag

When starting to trade, one crucial element often overlooked is the effect of commission drag. For a strategy to break even, it must have returns in excess of the total commissions; this can make or break a system. Commission drag is the cost of trading, and while it is unavoidable, it can be managed or minimised by a few means.

Many traders use a broker of convenience, e.g., their bank or a broker that was cheapest at the time they began. But this may not be the best option. In this article, we’ll look at how different commission structures interact with various trading strategy types.

Commission Structures

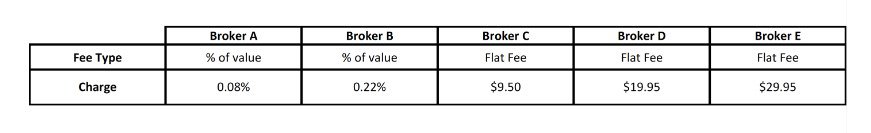

Commission pricing varies from broker to broker. Some take a flat fee, some take a price per share, some take a percentage, and some have a mix.

Deciding which commission structure is best for a strategy depends mainly on the trading frequency and the amount of capital used.

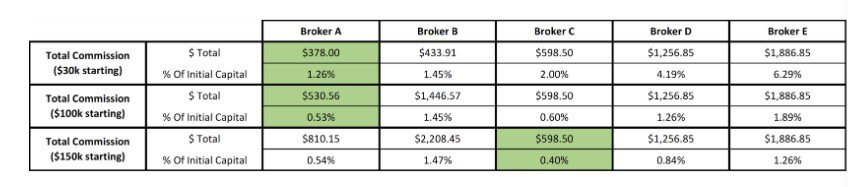

The table below details five simplified commission structures, each based on those of major Australian retail brokers.

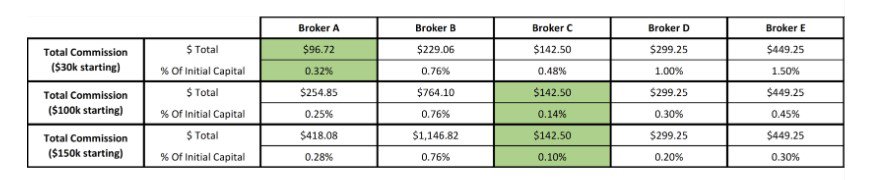

Using RealTest, we will test three different strategies with increasing trade frequency, using the above commission models. Each strategy will be tested across the same one-year period from 2020–2021.

Strategy A – Total Trades: 15

The first strategy we will look at is a monthly rotational strategy with five positions. As far as systematic trading goes, this is about as low frequency as it gets.

Strategy B – Total Trades: 48

The next strategy is a buy and hold momentum strategy that trades daily.

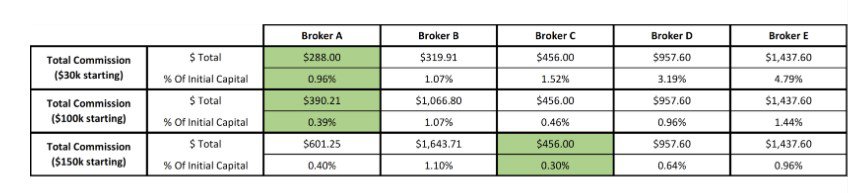

Strategy C – Total Trades: 63

The last strategy is a swing strategy trading up to ten positions on a weekly basis.

Comparison

Across all systems, Broker A performed the best when the initial capital was low. But when the positions became larger and the frequency lower, it was beaten out by Broker B with the lowest fixed-cost fee. At these larger capital values, however, the commission drag was already significantly lowered, making the difference between Broker A and Broker B largely insignificant.

Broker E, the highest of the fixed-cost fees, had total commissions well above all the others when the starting capital was lower. The commission drag of Broker E would take a significant toll on the performance of all three systems, significantly dampening the returns, and making the higher frequency strategies untenable at lower allocations.

The difference between the lowest and highest brokers on Strategy C is just over 5%, a vast difference when comparing a years trading returns.

Tips for Reducing Commission Drag

With the above in mind, here are some tips to reduce your commission drag:

- Lower the trading frequency: Hold stocks for longer or investigate trading at a different frequency, e.g., weekly instead of daily.

- Increase position allocation: To lower the percentage impact of drag, consider increasing the size of positions by adding capital or reducing the total number of positions.

- Increase overall allocation: If you are trading many smaller strategies, you may be better off consolidating them into one or more larger strategies.

- Change brokers: Consider moving to a broker with a lower or different commission structure.

No-Fee Brokers

In the last ten years, there has been a rise in brokers that charge the trader no direct fee for order execution. These brokers make money on these no-fee trades via Payment For Order Flow, that is, the broker receives a small fee for sending the order to specific market makers. The result is that the trader may not receive the best possible price for their order. As a general rule, we do not use No-Fee brokers.

Conclusion

While commission drag is only one of the aspects to consider when choosing a broker, it can have an impact on your trading more significant than many realise. When assessing a trading strategy, do you take commission drag into account?