A Daily Ritual Leads to Trading Success

Do you have a daily ritual when it comes to trading?

Today’s stock trading question comes from Neil H. whose challenge is:

“A challenge I seem to face regularly is to not look at a closed position result as a win or a loss but to treat it as simply a figure that needs to be recorded in my master spreadsheet and to realize that what really counts is the aggregate result of these entries at the end of the financial year.”

It’s convenient to forget that Tiger Woods smacked golf balls for 10+ hours a day over 15 years before he appeared on the radar. I’d bet a years salary that not every one of those days was enjoyable, indeed, I’d bet that many of those days were down right joyless, gloomy and discouraging.

A little like trading sometimes.

Which is why you need to view the day to day job of trading as a process rather than an outcome.

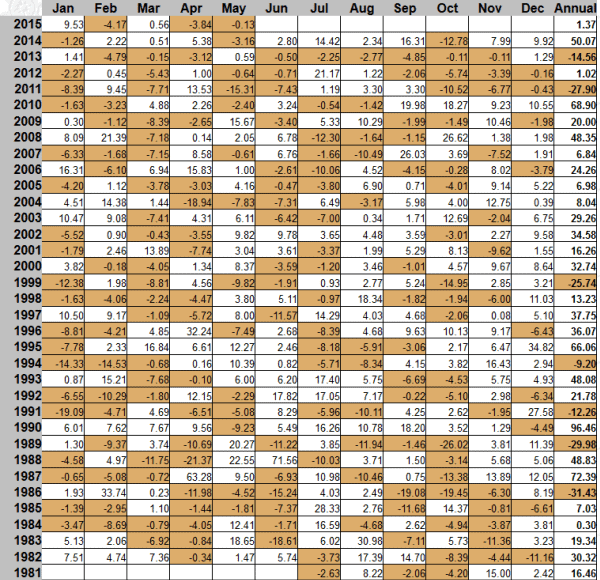

Here’s an exercise I do a lot. Below is the monthly profit and loss table of David Druz, arguably one of the worlds best traders; 30-year annual return of 17% net of 25% performance fee subtracted. But forget the end result for the moment and focus on the small steps – the process.

Firstly, he probably makes some 400 trades a year. Not only is he making trades, he’s adjusting trades each and every day. Place. Adjust. Execute. Adjust. Execute. Place. Adjust. Execute.

Secondly, he’s done this every day, every week, every month, every year for 34-years to get to this level of success. And just like Tiger Woods, I’m sure there are days, weeks and maybe even the odd year where he shakes his head and asks, “…what the heck am I’m doing?”

The secret is to focus on the daily ritual. If you can get the daily ritual down to a simple and automatic routine, then the end result will look after itself.