Trend Following

Nick Radge has been trading since 1985. In this article he explains his style of trading; trend following.

You define yourself as a trend following trader. What is trend following and what are some of the benefits of trend following versus other trading styles?

The easiest analogy I can come up with for trend following is that it’s like being a hitchhiker. We’re not predicting the market, we’re not analysing shares, we’re not using any fundamental analysis. At the end of the day any kind of trading, whether you’re a fundamental investor, value investor, or whatever; the profit is made from price movement. Price has to move from A to B in order to generate a profit. That’s the bottom line. It doesn’t matter how it gets there, what drives it, but in order to turn a profit, price has to go up.

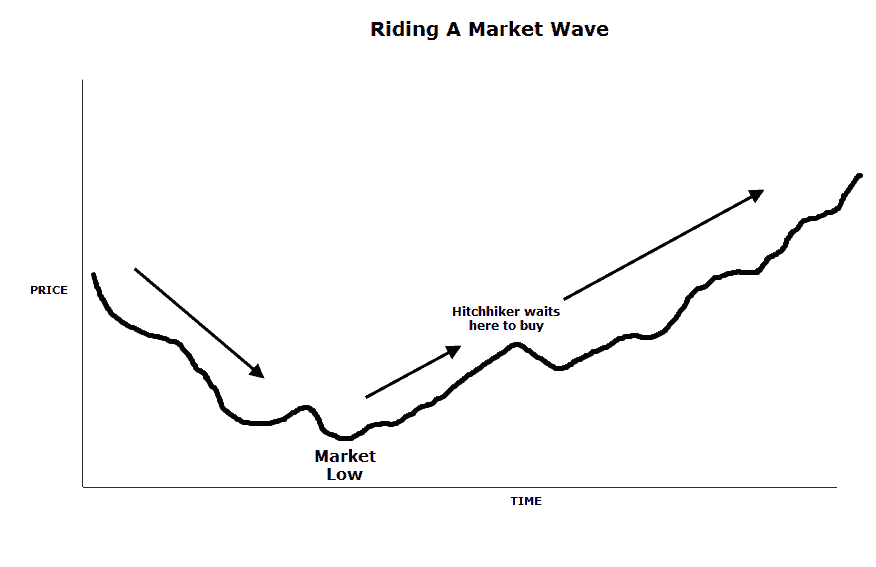

So as a trend follower, that’s all we’re interested in – following the trend in the price. If we use the analogy of a hitchhiker, let’s say you’re in Brisbane, and we need to hitchhike to Cairns, which is in the north. So the first thing we’re going to do is stand on the northbound lanes of the Bruce Highway for the simple reason that a car that is going to Cairns is more likely to be traveling in the northbound lane than in the southbound lane. So with the stock market, what we do is we position ourselves in the right direction of the price movement, i.e. we only buy stocks that are moving up.

The next thing with the hitchhiking analogy is that we don’t know what car is going to stop, but if we stand on the side of the road for long enough, we do know a car will eventually stop and same with the stock market. We don’t know what stock is actually going to go up, but we do know somewhere, sometime, a stock will be going up. And then once we jump on board that ride, we don’t know where it’s going to stop. So for example, if we hop on a ride in Brisbane, we don’t know if it’s going to stop in Noosa. We don’t know if it’s going to keep going to Rockhampton, Townsville, or maybe, if we’re lucky it’ll go all the way to Cairns. This is the same with the stock market. We don’t know how far the share price is going to go, but we will stay on that ride so long as it keeps going in the right direction. As soon as it turns around we will hop off.

The basic premise of how we make money therefore is that when we get on a ride that lasts a long time we make a lot of money, and when we get on a ride that doesn’t do well we only lose a small amount of money. We may only get it right 50% of the time, and to the average person that probably doesn’t represent a great deal of success. But mathematically, we make a lot more money on those 50% that we’re right. We might make, say, $3 on each profitable trade, and when we’re wrong we only lose $1. So mathematically, that’s how we make money.

In my view, that’s the easiest concept to understand. It’s the easiest way to actually generate money in the markets. Psychologically it’s a little bit difficult because these rides don’t come along every day. The stock market especially offers quite high correlations. So you will have periods of time where lots of stocks are moving very, very well, and you make a lot of money. Then there will also be periods of time when the stock market’s moving sideways, and some of those rides aren’t available, which can be very frustrating. But you’ve got to take both sides of the equation.