Losers Make the Best Winners

Losers make the best winners – something new parents should teach their children instead of giving everyone a prize just for showing up. It’s no different in the stock market. Learn to lose, or more importantly, how to manage losses and you will be the winner.

Stock Trading

Stock trading is a game of mathematics. Your goal is to make the maths work in your favour.

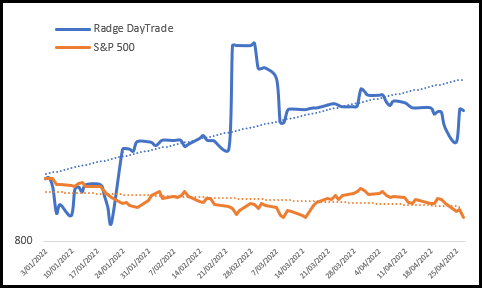

You can be a highly profitable trader and lose more often than not – indeed, some of the world’s top traders lose more often than they win. My current winning percentage of trades is just 43% for my Growth Portfolio with an average non-compounded return of 9.32% per annum versus the benchmark of 3.17% .

Ask yourself: would you prefer to risk $1 to make $2, or risk $1 to make $5?

Of course, we’d prefer to aim for the higher reward for the same risk. However, once the probability of success, or more importantly the possibility of actually being wrong, enters our mind we tend to change the way we think. We revert back to our core beliefs of right and wrong. Because we are usually required to be right in order to achieve reward, we then start thinking that we could be wrong – and so lose money as well – and it becomes a difficult issue to deal with.

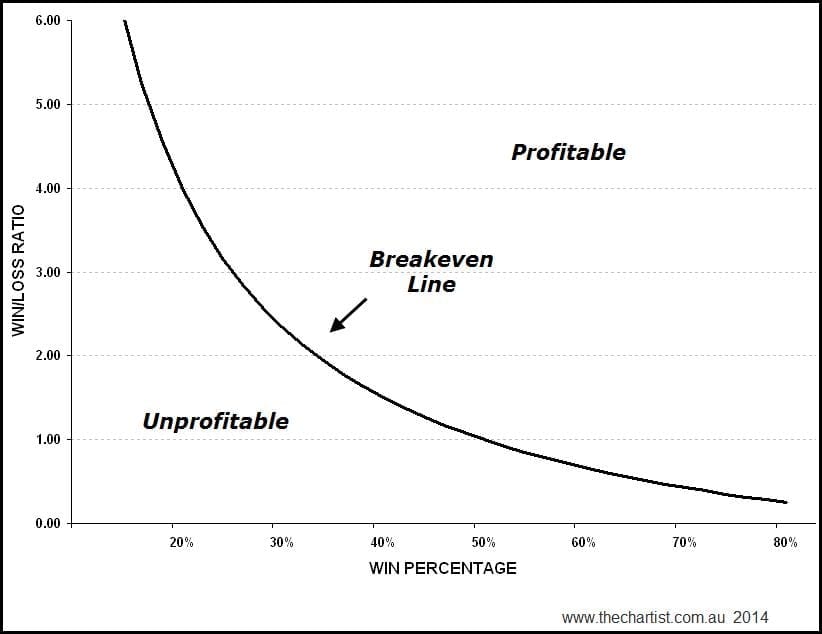

Figure 1 shows a visual representation of the expectancy curve.

This curve is made up of two elements – the win percentage and the win/loss ratio. The win percentage simply means the accuracy of your trading. The win/loss ratio is calculated as the average profitable trade divided by the average losing trade. If after 20 trades the average winner is $200 and the average loser is also $200, the ratio is 1:1. If the average win is $400 and the average loss is $200, the ratio is 2:1. The goal is to be in the upper portion of the graph below or the area of positive expectancy, and therefore profitability. Most people find they hug the dividing line between profitable and unprofitable trading and, as a result, spend their time alternating between being a marginal winner and a marginal loser. (Just as a side note, no manner of money management will save you if you operate on the negative expectancy side of the curve.)

In order to trade deep in the upper expectancy area, an experienced trader will concentrate on the win/loss ratio, not the winning percentage (or accuracy) of the strategy.

Investment Newsletter

I watched an infomercial advertising a well-known investment newsletter. They claimed an accuracy rate of 73 per cent with an average profit of 10.3 per cent per recommendation. Obviously, the company hoped that this would encourage people to think they would make money by following the tips and they would therefore subscribe to the newsletter. What they failed to mention was how much on average they lose on the other 27 per cent of their recommendations. If their average loss exceeded 27 per cent, they would be net losers. I don’t remember them mentioning that part, though.

Perhaps you’re thinking I’m not that smart or that I haven’t thought things through enough – surely if I had, I could win more often than 50 per cent of the time? However, after many years of computer simulation, real trading and reading almost everything written on the topic, the same conclusion always comes forward – maximise the winners, minimise the losers. Or as I like to say, cut your losses and let your profits run.

If you are serious about learning to design your own robust trading system our Trading System Mentor Course might be if you. Otherwise if you are interested in starting with the basics Beginners Guide to Building Trading Systems is a great start.