Inside Trailing Stops

Inside Trailing Stops

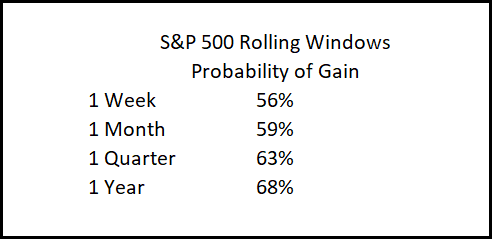

As a trend follower, success comes from allowing positions to run as far as possible and exit only when the trend has terminated.

The key tool to accomplish this is a trailing stop.

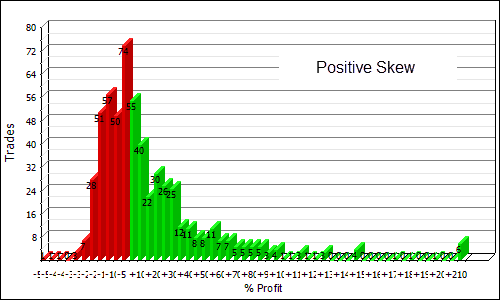

A trailing stop is an exit that is set a fixed amount below (above) the current market price. As the market price rises, the stop price rises by the trail amount, but if the stock price falls, the stop loss price doesn’t change, and the position is exited when the stop price is hit. This technique gives trend following its all important positive skew…

Examples:

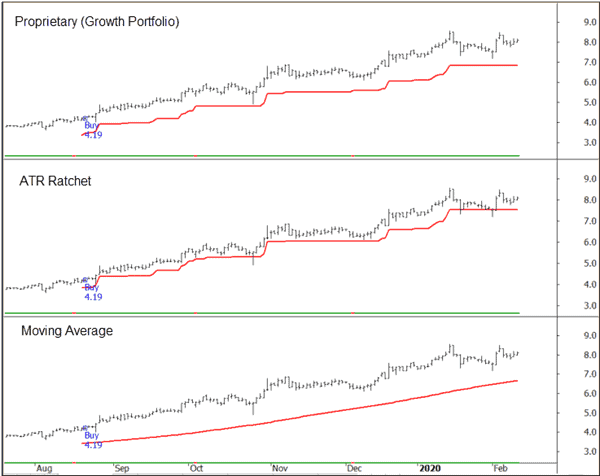

Below are three examples of trailing stops at work.

The first is the proprietary stop used for the Growth Portfolio and whilst it’s similar to traditional methods it does provide us with a good edge which we’ll see below.

The second pane shows an ATR Ratchet, sometimes called a Chandelier Stop, known by that name as it ‘hangs’ from the highest point in the trade. It is calculated using the average true range (ATR) of the stock and then multiplied by a factor, in this case 5.

The last pane shows a very common moving average trailing stop, in this example the 100-day simple.

Our research has shown that a daily close below the stop level tends to provide the best results.

Growth Portfolio Entry Trigger

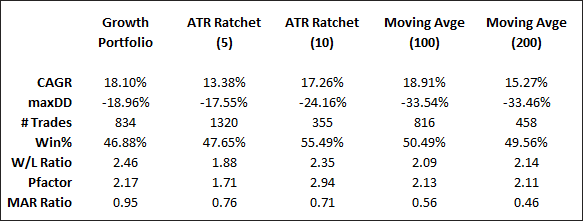

Let’s put a few of these to the test using the Growth Portfolio^ as the entry trigger.

For this we’ll use:

Universe: ASX All Ordinaries Index including historical constituents (2026 symbols).

Period: Jan 1 1999 through today

Comm’s: 0.08% or minimum $6

Dividends: Yes

Interest: Nil

The results more or less show the same trend-style metrics; win rates around 45% – 55% and win/loss ratio’s mostly above 2.

Each type of trail stop has its pros and cons and none will capture each and every trend perfectly. The proprietary method was developed over many years of research and real time trading.

Trailing stops are a balancing act.

They need to be wide enough to allow price to ebb and flow in its normal manner so larger trends can be ridden. However, not so wide that when the trend does reverse, large profits aren’t given back.

There are two elements that are vital to success:

(1) trail stops should be tested across a large array of symbols to validate robustness.

(2) don’t get hung up on a single trade where the trail stop wasn’t perfect.

^ The Growth Portfolio is a variant of the Bollinger Band Breakout strategy discussed in Unholy Grails.