Cash or Reallocate? Managing Portfolio Protect Mode

This week, a Chartist member asked:

“I am trading both the US Momentum and US All Weather strategies, with $50K allocated to each. When the US Momentum strategy enters Portfolio Protect mode, should I keep the $50K allocated to cash, or should I invest it into the US All Weather strategy?”

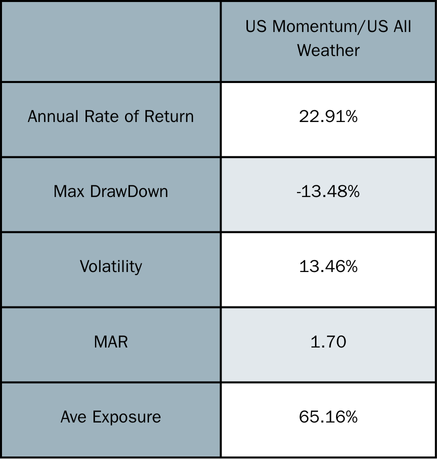

This is a great question and an interesting topic to explore. To establish a baseline, the following simulation assumes a total portfolio of $100,000, evenly divided between both strategies and rebalanced regularly to maintain a roughly equal split. The test is conducted from 1st January 2014 to 1st April 2025.

A key observation is how these strategies complement each other to help control volatility. The US Momentum strategy is designed for high growth, while the US All Weather strategy targets consistent, low-volatility returns.

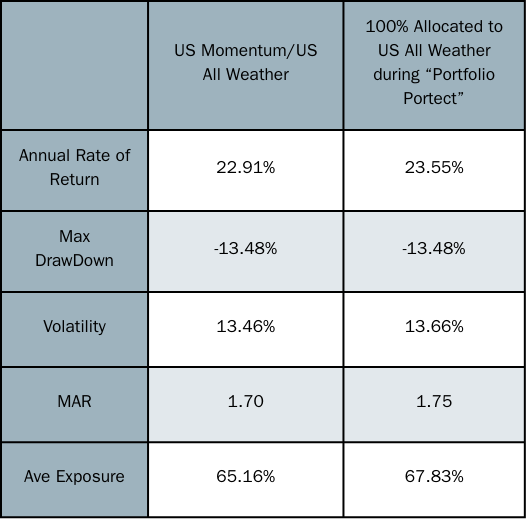

Next, a test was conducted to examine the impact of allocating 100% of the portfolio to the US All Weather strategy whenever the US Momentum strategy enters Portfolio Protect mode. Typically, when US Momentum is in Portfolio Protect, that portion of the funds is moved to cash and reinvested when the Index Filter signals a re-entry.

At first glance, the returns were expected to be slightly higher. However, the maximum drawdown remains unchanged, and overall volatility is only slightly affected. Another notable statistic is that the average exposure increases only marginally from 65.16% to 67.83%. Again, this is surprising, a deeper look into the data explains why.

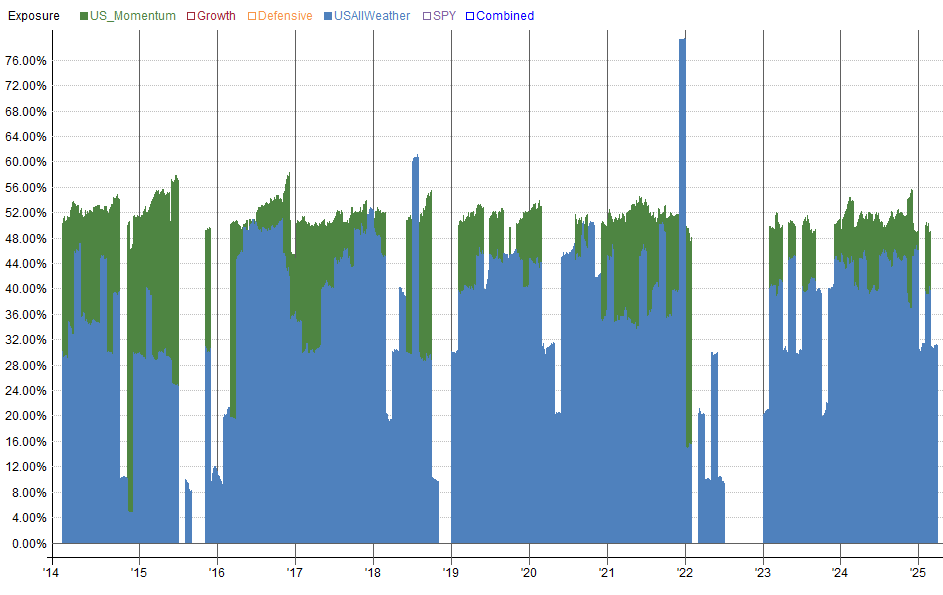

Certain aspects of the US All Weather strategy use an index filter that, while different from US Momentum’s, functions similarly. This results in a lower overall allocation to the growth portion of the portfolio, which is a key factor in controlling volatility. As the chart below illustrates, exposure to the All Weather strategy rarely exceeds 50%. This is because, when US Momentum enters Portfolio Protect mode, there is a high probability that the US All Weather strategy is also reducing its growth allocation.

In this scenario, the portfolio’s defensive allocation is effectively doubled, with the remaining balance held in cash. In some instances, no positions will be held at all. Extensive testing confirms that this dynamic is crucial in maintaining lower overall volatility.

Is it worth taking on additional risk for a slightly higher return? That ultimately depends on individual risk preferences. This analysis highlights the importance of examining data rather than making assumptions of potential returns.

If you are interested in exploring our portfolios performance, the Systematic Portfolio Guidebook is available as part of our free trial. It provides a detailed breakdown of both back tested and live returns, as well as combined portfolio statistics.