Testing the Limits: Leveraging Momentum Strategies

A question from a Chartist member this week:

“What would be the impact of using different amounts of leverage (e.g., 20%, 30%, etc.) on momentum strategies?”

Leverage allows traders to borrow capital from their broker to trade larger positions than their account balance may allow. While this can amplify profits, it also magnifies losses—making leverage a high-risk tool.

Why Leverage and Momentum Strategies Don’t Mix

Momentum strategies rely on riding long-term upward trends while ignoring short-term fluctuations. Momentum strategies tend to exacerbate market conditions in both directions, meaning a market downturn can hit twice as hard if not managed correctly.

When you introduce leverage, these drawdowns are magnified again. The combination of inevitable drawdown paired with magnified price movements makes leveraging these momentum strategies intolerable for the vast majority of traders.

At The Chartist, we only use leverage for short-term mean-reversion strategies, where price fluctuations are intended to revert quickly. But instead of taking our word for it, let’s put leverage to the test using real historical data.

Backtesting: What Happens When You Add Leverage?

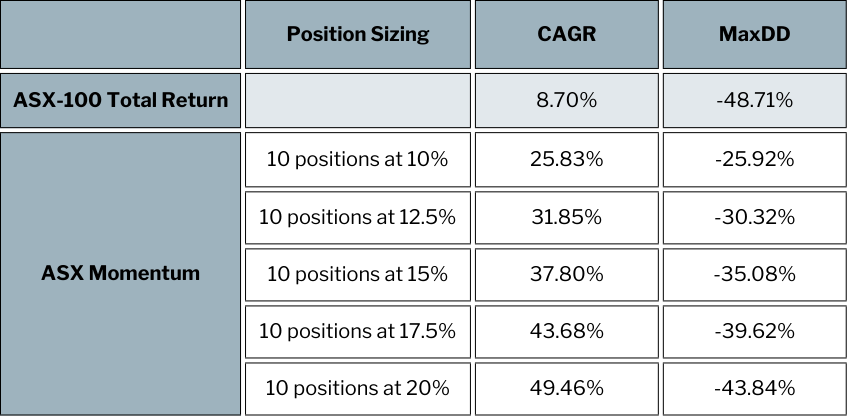

We ran a backtest on our ASX Momentum Strategy, covering the period from 2000 to January 2025. We compared its performance to the ASX 100 (Total Return) Index, the universe from which the ASX Momentum trades, to see how leverage impacts returns and drawdowns.

What Does This Mean?

- Even a small amount of leverage increases drawdowns significantly.

- At 12.5% per position, drawdowns exceed -30%, which is already uncomfortable for the majority of traders.

- By 20% per position, drawdowns reach -43.84%, far beyond what most traders can tolerate.

- Returns increase with leverage, but risk rises at an even greater rate.

- While the CAGR improves, it comes at the cost of extreme drawdown. A trader must ask: Am I willing to experience a potential 40%+ loss to chase higher returns?

- Backtest drawdowns can be exceeded in real trading.

- A backtested drawdown is based on true historical data, but that does not mean the result in the future can’t be worse.

If you think you can handle a -40% drawdown, open your brokerage account and calculate what that means in actual dollar terms. Now imagine that amount disappearing by the end of the month.

Is Leveraging Momentum Strategies Worth It?

For most traders, the answer is no. While leveraging can boost returns, when used on momentum strategies it comes with unbearable drawdowns. Even a relatively mild amount of leverage can push losses beyond practical limits.

If you’re interested in building, testing, and refining your own strategies, check out our Beginner’s Guide to Building Trading Strategies to learn how to stress test and improve your approach before risking real capital.