Protecting Capital During A Downturn

If you are following along with our membership portfolios, you may have noticed that a handful of our strategies have moved from Invest to Portfolio Protect mode. While it may seem like an odd move for some of our portfolios, such as the US Momentum, which has just had a +77.57% gain across 2024, there is good reason for this. So, what is protect mode, why have some portfolios moved there, and how long will we stay there?

What is Portfolio Protect?

Portfolio Protect mode is simply when we temporarily pause entries for a portfolio and sit in cash. Some portfolios may take the extra step of exiting all positions immediately. This protect system was developed after the GFC of 2008 and is based on extensive research and backtesting over long periods of historical data.

Since the GFC, the protect mechanism has proven incredibly effective at avoiding the worst of large market downturns and proved especially useful during the COVID market crash.

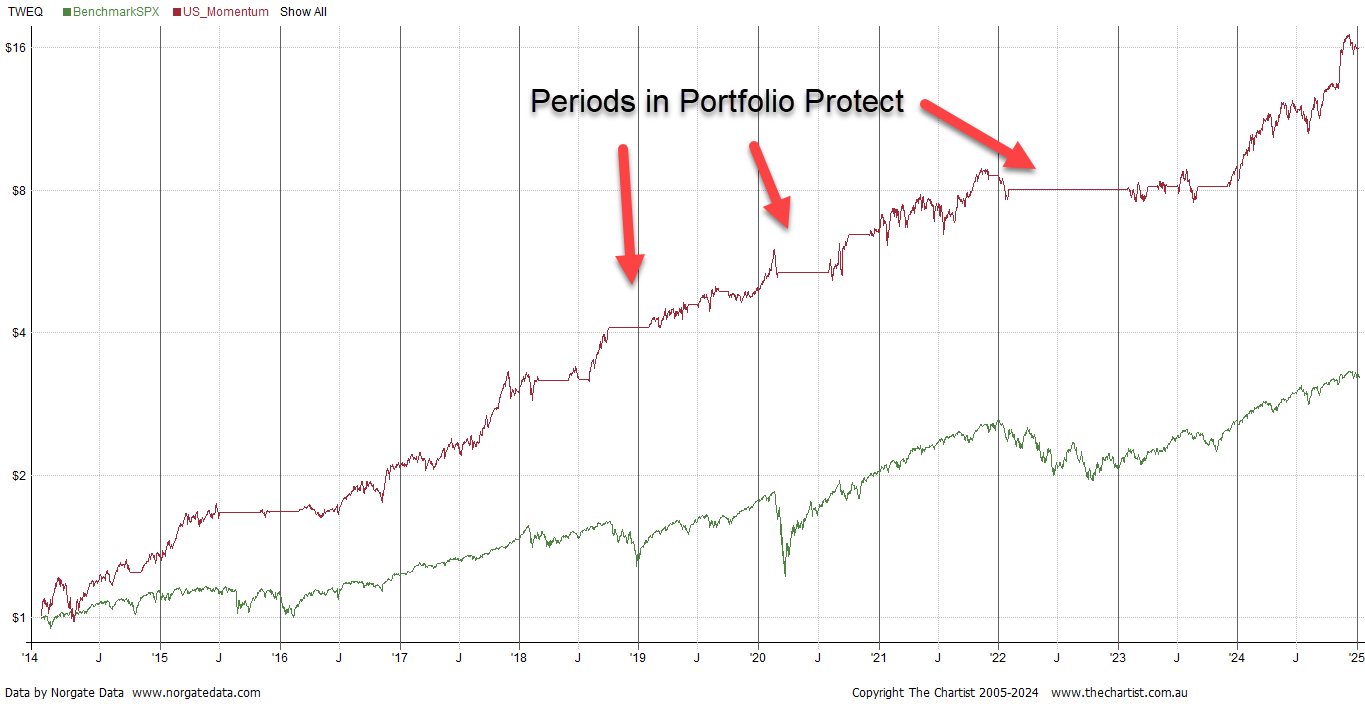

The usefulness of this can be seen on the equity chart of a US Momentum backtest below. The flat spots show when the portfolio has moved to cash, coinciding with market downturns on the S&P 500 plotted concurrently.

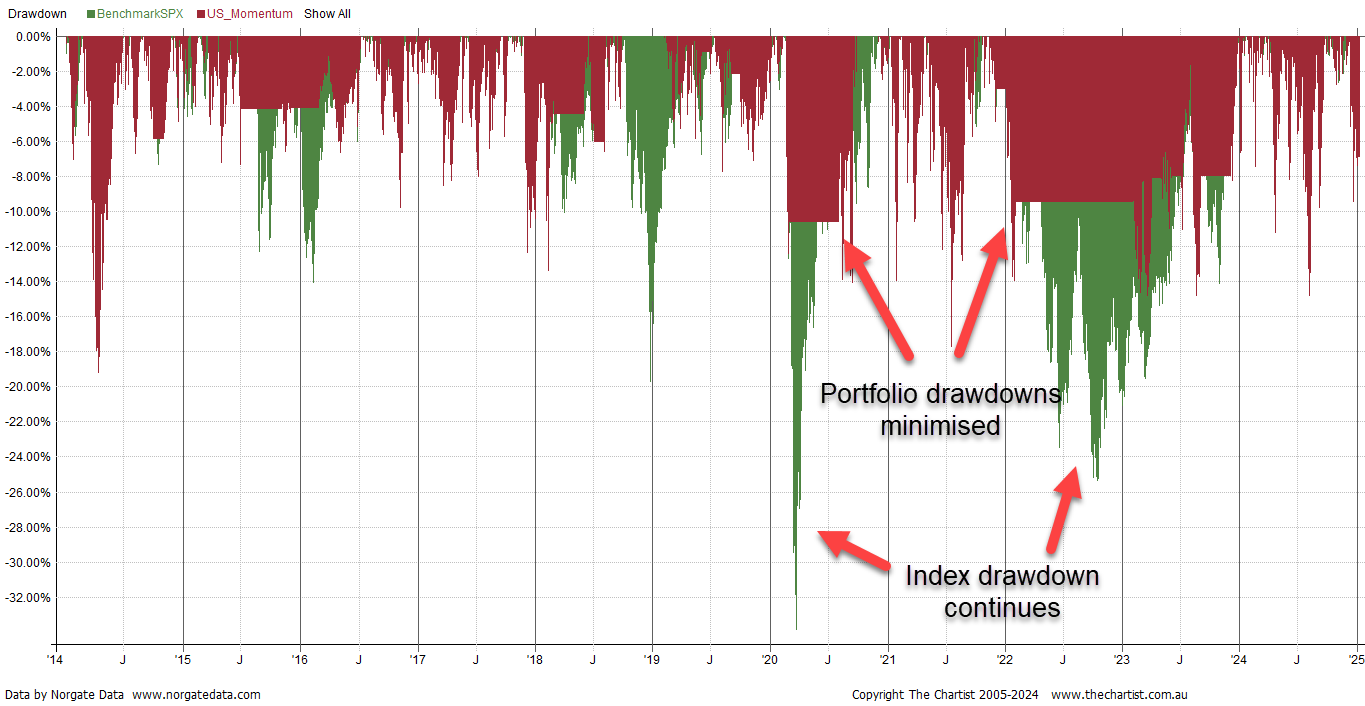

We can also see this demonstrated on the drawdown chart for the strategy below. Note how the drawdowns on the portfolio plot are halted before the peaks of the index drawdown are reached.

Another great example of this is the Trade Long Term portfolio, which returned +97.43% in 2020 despite being in portfolio protect for 3 months of that year, in comparison to the S&P 500 which gained +16.30%.

Are you saying the market is about to crash?

No.

The portfolios are taking a defensive stance, and there is every chance the portfolio protect status could last for only this month. The US Momentum was in cash for October and November 2023, before returning +77% in 2024.

But what if I don’t want to sit in cash?

That’s fair enough; it can be difficult to sit on the sidelines, but it’s more difficult to sit through significant losses without intervening.

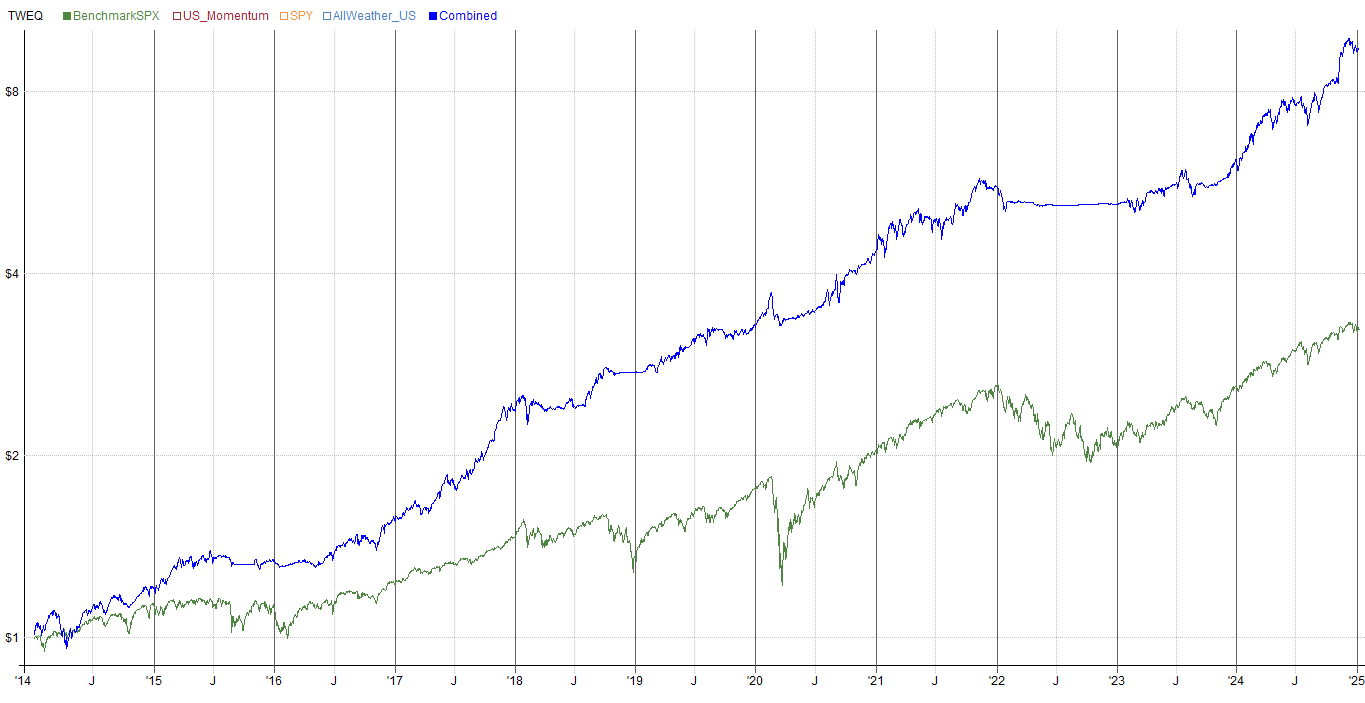

Thankfully, we offer multiple strategies that can be combined so investment can be continued while a part of your portfolio is in cash.

The below backtest shows the US Momentum and US All Weather strategies combined. The US All Weather invests in a variety of different assets, so it has exposure beyond equities into bonds, commodities, bitcoin, etc. This means the US All Weather can continue to operate while the US Momentum is on the sidelines.

If you’d like to learn more about our portfolio offerings, take a free trial now to gain full access to the performance metrics, live trades, and historical trades for all of our strategies. We also discuss how to build your own regime filter for portfolio protect in our Weekend Trend Trader eBook which is available free within the member’s Education area.