Hey All,

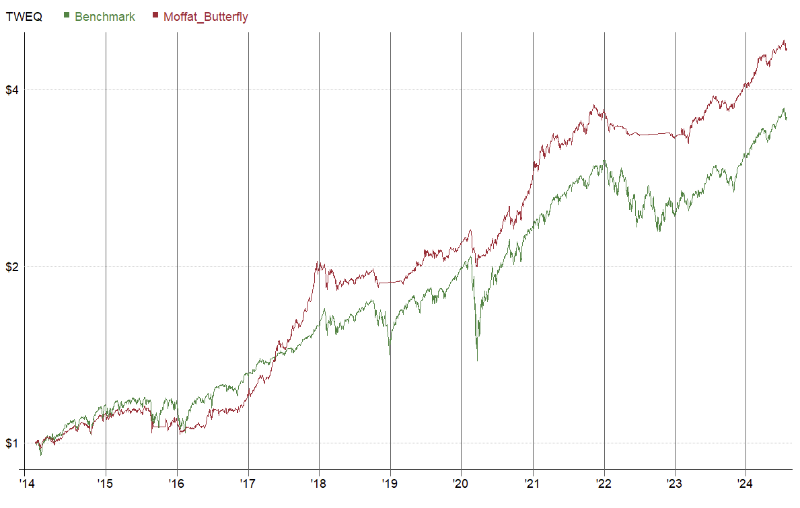

I’ve been working on an All Weather style system and looking for some ideas to improve the results

I’ve currently have a portfolio of ETFs (US) that are

– stocks – 30%

– stocks – 30%

– commodities – 10%

– metals – 10%

– alternate – 10%

– fixed income – %10%

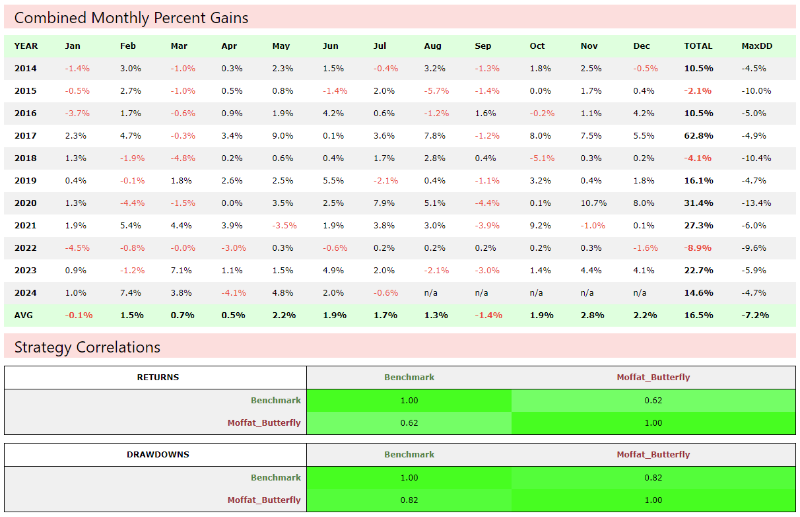

I have simple timing filter to enter (200MA) and it trades once per month.

I have been experimenting with trading more regularly, different variations of the ETF’s and some intra month stops. So far, nothing gets me better results than I already have.

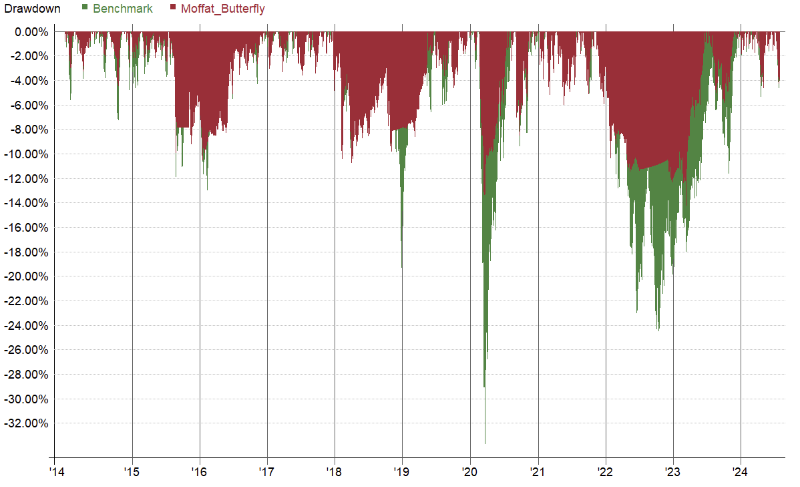

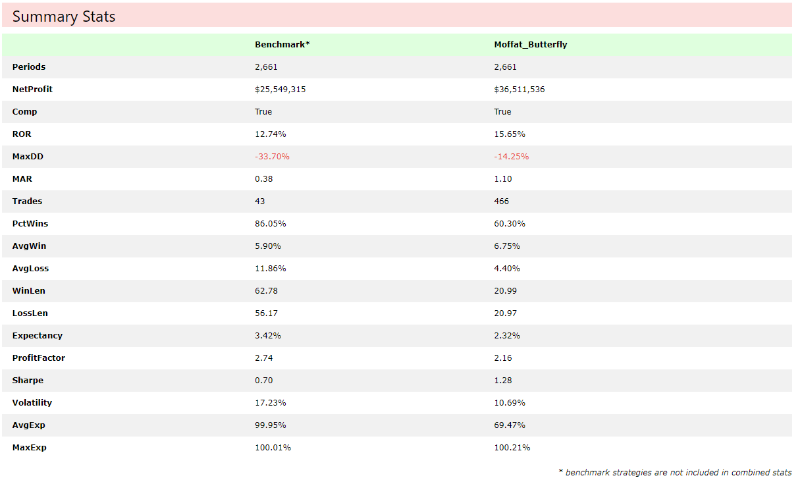

Also, by better, I’m mainly interested in lowering volatility further and/or reducing DD%.

Has anyone had any success or ideas that they could share?