Home › Forums › Trading System Mentor Course Community › Trading System Brainstorming › Capturing Gaps UP on OPEN While Managing Risk (STOP Orders)

- This topic is empty.

-

AuthorPosts

-

February 13, 2024 at 5:22 am #102288

GlenPeake

ParticipantIn a nutshell what I’d like to achieve is capturing stocks that I’ve identified (after hours) as stock(s) I’d like to place a BUY order for, in the following session but only if the stock ‘Breaks Out’ in the session. So far, I’ve been using BUY STP LMT orders for this and attach a STOP order with it, which has been working fine…. and keeps my risk management intact as the BUY Limit value is known in advance etc

However when a stock Gaps Up significantly ABOVE my BUY LIMIT order and doesn’t retrace, I miss my fill. Example being SMCI. (FWIW: I’m trying to capture Episodic Pivots, but capture them while I’m not watching the screen…. i.e. I’m asleep when the US market opens).

I thought I might be able to use a BUY STP order and attach a STOP TRAIL ($ Amount) with it, but IB won’t allow this combination of orders to be combined together.

So, I’ve been testing out BUY STP LMT and TRAIL as a combination and it seemed to work OK last night…. provided my BUY LIMIT amount is high enough to capture the GAP UP (without triggering any IB orderly market/too far from market % thresholds).

So, I’d thought I’d ask the question here to see if anyone knows of another approach that might work OK.

Again, as an example SMCI

18/1/24 SMCI closed @ $311.44 (High/Low of $334 / $306.67) with a 20 day ADR of $17.67.

If I wanted to Buy when $334.01 or higher trades I can still use a BUY STP LMT order, with a Limit e.g. 342.55 and use a Trail Stop amount of $17.67 (i.e. 20 day ADR value and I can base my position sizing/ risk around this value)

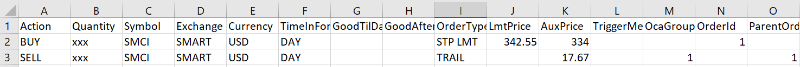

Action Quantity Symbol Exchange OrderType LmtPrice AuxPrice OcaGroup OrderId ParentOrderId

BUY xxx SMCI SMART USD STP LMT 342.55 334.01 1

SELL xxx SMCI SMART USD TRAIL 17.67 1 1

On 19/1/24 SMCI opens at $347.56, my BUY STP LMT order will get triggered and sent with a Limit of $342.55 and STP of (342.55 – 17.67 = 324.88)

SMCI hit a low of $338.88, therefore the STP is not triggered etc….Just wondering if others have an alternate / better way / thoughts around the use of an alternate order combination?

Using the above method, I’ll get stopped out on those occasions when/if the stock gaps up high on Open and then fades / retraces through my BUY Limit / Trail limit etc. e.g (see STNE yesterday 12/2/24 as an example), but I’m prepared to accept those.

Obviously, once I’m in the trade and it goes in my favour, then I can manage the STOP, using my normal method….. it’s just the initial entry and managing my risk/stop upon entry on Day 1 I’m looking to refine and keep risk in check etc…

Thanks.

February 14, 2024 at 10:09 pm #115976Nick Radge

KeymasterThe only other option is possibly the Adjustable Stop

https://www.interactivebrokers.com.au/en/trading/orders/adjustable-stop.php

February 15, 2024 at 2:13 am #115981GlenPeake

ParticipantThanks Nick.

Wasn’t aware of the “Adjustable Stop”… will take a look into it. -

AuthorPosts

- You must be logged in to reply to this topic.