Home › Forums › Trading System Mentor Course Community › Trading System Brainstorming › ASX WTT

- This topic is empty.

-

AuthorPosts

-

November 4, 2024 at 12:03 am #102284

KateMoloney

ParticipantHello,

When I load my BUY orders for WTT, I usually enter on a LIMIT order (close + 5%) instead of a market order.

Recently I missed a trade that jumped 50% in the first 3 hours of trading. It stayed there towards the end of close, so I entered at the new price.

What would best practice be? Miss the trade? Or enter at the higher price ?

November 4, 2024 at 12:08 am #116374KateMoloney

ParticipantAnother question…

I’m sure its somewhere in the forum, but I can’t find it

What do others do to monitor their ASX positions for trading halts or sale of share to private company ?

Is there a website where you can set up an alert? Or do you just do a google search of the ticker before entering the trade?

Thanks in advance.

November 4, 2024 at 12:33 am #116375smurfki0808

ParticipantHi Kate,

This question was one of my very first questions to Nick some years ago, before doing the Mentor program!

I too place my WTT LIMIT orders before open, and have seen prices gap up through the order at open. I don’t chase it. These days, I leave my order as is for the week to see if it fills later at my price, but otherwise look for the next signal.

I think Glen P has mentioned that he does his best to get in on the open, what ever it is.

Its hard watching those rockets whiz by sometimes.

November 4, 2024 at 6:17 am #116379KateMoloney

ParticipantThanks for sharing Sean.

Its a toss up isn’t it? Between entering at the market VS on a limit order.

I may experiment with both and track the differences. My liquidity filter is high, so maybe on open it wouldn’t matter so much.

November 5, 2024 at 4:56 am #116376GlenPeake

ParticipantYeah….My process is to grab the OPEN price for WTT entries. That’s the way it’s tested and the way I’ve gone about it for years etc…. I try not to overthink it too much, as I know if I get ‘fancy’ and ‘outsmart’ the entry etc, it generally results in sub-optimal fills.

But for you Kate, with that stock that pumped 50% on the day…… that sounds a bit of an extreme move, even for me to grab. If the pre-open was i.e. 10%-20%, I’d still try to get the open….. beyond that… as an option then maybe you could consider partial positions…. e.g. grab 1/4 of the position on open, a 1/4 of the position on close and / or smaller chunks during the day, depending on liquidity etc.

re: NEWS on company….. If Google Search doesn’t produce something meaningful…. IBKR does have a company specific news feed you can cross check.

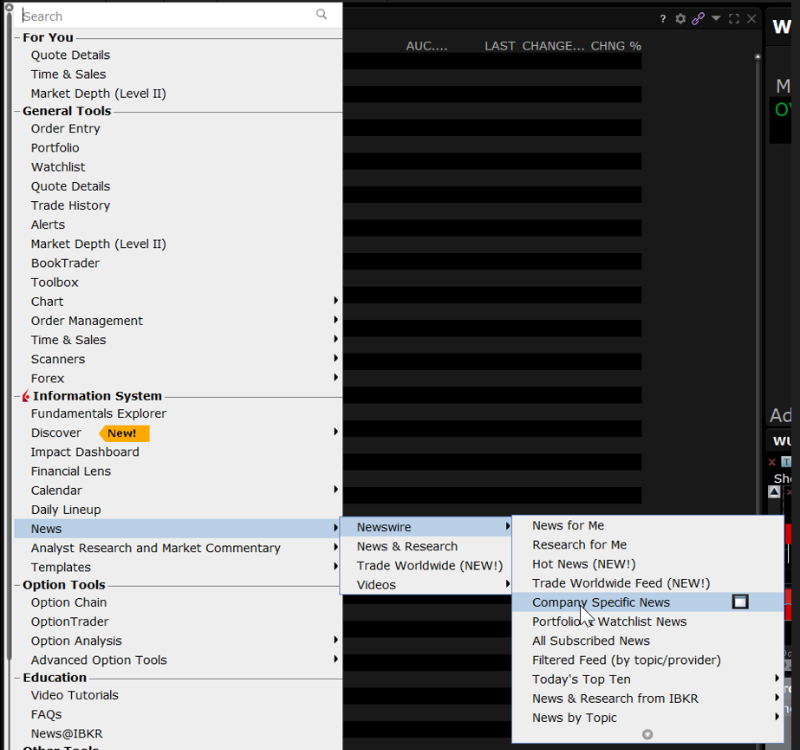

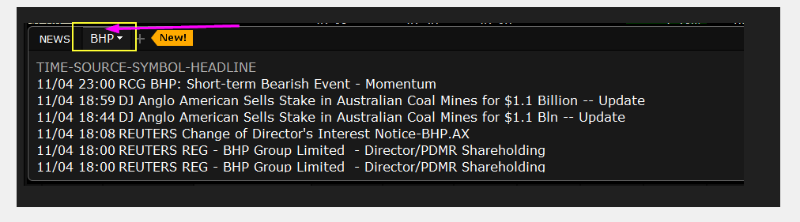

Click NEW WINDOW > NEWS > NEWSWIRE > COMPANY SPECIFIC NEWS and then in the window that appears, type in the TICKER code of the stock and scroll thru the List of news items and select the one you want to read (BHP used in the screen shot below).

November 5, 2024 at 5:10 am #116377

November 5, 2024 at 5:10 am #116377GlenPeake

ParticipantWhile I think of it, if you do ‘skip’ an entry in LIVE trading, e.g. it’s going thru a takeover/buyout and you decide not to take the signal, and want to generate a ‘new’ signal instead i.e. you’d rather use the position slot NOW instead of waiting around for the takeover to complete (which might take weeks)….then have a read thru this thread that I posted on the RT forum…… where you can manage your LIVE positions and ensure it remains sync’d up to your Order Script list…

My Post: https://forum.mhptrading.com/t/delisted-tickers-excludelist-combinations/4449/5

Details for managing ‘takeovers / buyouts’: https://forum.mhptrading.com/t/question-about-excludelist/3050

(Previously I was just excluded the ticker using the ExcludeList: xyz.au option….. the above ‘buyout’ method via an eventlist, seems ‘cleaner’ atm to me).

-

AuthorPosts

- You must be logged in to reply to this topic.