Home › Forums › Trading System Mentor Course Community › Trading System Brainstorming › A simple ETF strategy

- This topic is empty.

-

AuthorPosts

-

April 12, 2023 at 7:53 am #102267

Nick Radge

KeymasterHere’s a simple ETF strategy that might be good for a conservative retirement account At the end of each month:

(1) Ensure the trend of #NYSEHL is up

(2) Ensure the trend of the $SPX is up

(3) If (1) or (2) is true, calculate the rate of change of $SPY and $GLD for the last 150 days

(4) If (3) > 0, the buy strongest. If (3) < 0, then stay in cash CAGR: +11.2% maxDD -20.5% Exposure: 74% August 3, 2023 at 12:16 am #115540

August 3, 2023 at 12:16 am #115540PaulBailey

MemberAnyone else having a go at replicating / repeating this?

I’m trying……….

August 11, 2023 at 11:09 pm #115701KateMoloney

ParticipantMy version gets 11% CAGR with a -38% maxDD, but it hasn’t accounted for interest on cash and I used monthly bars.

I don’t think I’ve coded in the off switch properly either….

Nick or Craig, how to do you code for interest on cash? Do you use a bonds ETF to do this?

August 11, 2023 at 11:15 pm #115709KateMoloney

ParticipantWork in progress code

Notes:

All weather example

1) If #NYSEHL is up OR SPY is up

2) If above is true, calcuate ROC for SPY and GLD in last 150 days

3) If the ROC is above 0, buy the strongest, if they are below 0, stay cashImport:

DataSource: Norgate

IncludeList: SPY, GLD {“ETFs”}

IncludeList: #NYSEHL, $SPX

StartDate: 1/1/1995

EndDate: Latest

SaveAs: AllWeather.rtdSettings:

DataFile: AllWeather.rtd

StartDate: 1/1/2005

EndDate: Latest

BarSize: Monthly

Benchmark: Benchmark

Side: Long

Allocation: S.Equity

EntrySetup: Symbol=$$SPX

Parameters:RegimeLen: From 1 to 18 def 12

RocLen: From 1 to 12 def 3 //Data:

Uptrend: Extern($$SPX, C > MA(C,RegimeLen))

HiLo: Extern($#NYSEHL, C > MA(C, RegimeLen))MyROC: ROC(C, RocLen)

MyRank: #rank if(InList(“ETFs”), MyROC, nan) // the “nan” means “don’t rank if not in ETFs list” (you can’t trade $SPX or #NYSEHL)Strategy: AllWeather

Side: Long

EntrySetup: MyRank = 1 // top-ranked ETF

ExitRule: MyRank > 1 // no longer top-ranked ETF

Quantity: 100 //

QtyType: Percent// Below items need work

// 1) Check that the uptrend and HiLow indicators are switched on – don’t think they are

// 2) Also need code to account for interest earned on cash ??? Bonds ETF or just interest on cash in bankAugust 11, 2023 at 11:23 pm #115710KateMoloney

ParticipantI’ve tried using the following to include the regime filter, seems to worsen results, don’t think I’ve coded it correctly.

Notes:

All weather example

1) If #NYSEHL is up OR SPY is up

2) If above is true, calcuate ROC for SPY and GLD in last 150 days

3) If the ROC is above 0, buy the strongest, if they are below 0, stay cashImport:

DataSource: Norgate

IncludeList: SPY, GLD {“ETFs”}

IncludeList: #NYSEHL, $SPX

StartDate: 1/1/1995

EndDate: Latest

SaveAs: AllWeather.rtdSettings:

DataFile: AllWeather.rtd

StartDate: 1/1/2005

EndDate: Latest

BarSize: Monthly

Benchmark: Benchmark

Side: Long

Allocation: S.Equity

EntrySetup: Symbol=$$SPX

Parameters:RegimeLen: From 1 to 18 def 12

RocLen: From 1 to 12 def 3Data:

Uptrend: Extern($$SPX, C > MA(C,RegimeLen))

HiLo: Extern($#NYSEHL, C > MA(C, RegimeLen))

Setup: Uptrend or HiLo

MyROC: ROC(C, RocLen)

//MyRank: #rank if(InList(“ETFs”), MyROC, nan) // the “nan” means “don’t rank if not in ETFs list” (you can’t trade $SPX or #NYSEHL)

Myrank: #rank Setup and if(InList(“ETFs”), MyROC, nan)Strategy: AllWeather

Side: Long

EntrySetup: MyRank = 1 // top-ranked ETF

ExitRule: MyRank > 1 // no longer top-ranked ETF

Quantity: 100 //

QtyType: Percent// To work on

// Check that the uptrend and HiLow indicators are switched on – don’t think they are

// Also need code to account for interest earned on cash ???

// And check that the system is in cashAugust 12, 2023 at 3:10 am #115711JulianCohen

ParticipantI haven’t downloaded and tested this but I think you need to have

EntrySetup: MyRank = 1 and Setup

remove the setup from the ranking. That will switch on/off the regime filter

September 12, 2023 at 9:17 am #115712StevenPola

MemberI gave it a crack as follows.

Robust feedback on where this is a little bit shite much appreciated. Its the only we we learn right……..!No commissions included but with only 39 trades this shouldn’t trouble the scorer too much.

Notes: Attempt to replicate “A simple EFT” strategy poste by Nick on Forum.

Import:

DataSource: Norgate

IncludeList: SPY, GLD, $SPX, #NYSEHL

StartDate: 1/1/00

EndDate: Latest

SaveAs: ChartistSimpleEFT.rtdSettings:

DataFile: ChartistSimpleEFT.rtd

StartDate: 1/1/05

EndDate: Latest

BarSize: Daily

UseAvailableBars: False

AccountSize: 100000Notes: There are 2 (Filter1) and 2 (Posrank). “//” without backdating the ROC that seems to work better with momo.

Data:

Reggie1: Extern($#NYSEHL, C > MA(C,20)) // Regime Filter – NYSEHL

Reggie2: Extern($$SPX, C>MA(C,200)) // Regime Filter – SPX

ReggieCombo: Reggie1 or Reggie2 // Regime Filter – Combined

//Filter1: ROC(C,150) > 0 // Momentum not backdated – as per Nicks Post

Filter1: ROC(C,150)[20] > 0 // Momentum Backdated by a month works better.

Universe: Symbol == $GLD or Symbol == $SPY // Define Universe to stop $SPX going into trades

canhold: ReggieCombo and Filter1 and Universe

//Posrank: #rank if(canhold, ROC(C,150), -1) // Remove $SPX and #NYSEHL from Ranking – as per Nicks Post

Posrank: #rank if(canhold, ROC(C,150)[20], -1) // ROC Backdated by a month works better.Parameters:

Positions: 1

Worstrank: 1 // Only 2 symbolsNotes: Benchmark with Dividends reinvested.

Benchmark: SPY

Side: Long

EntrySetup: Symbol=$SPY

ExitRule: Dividend > 0Strategy: Nick Simple ETF

Side: Long

Quantity: 100 / Positions

QtyType: Percent

MaxPositions: Positions

EntrySetup: EndOfMonth and canhold and Posrank <= Positions

SetupScore: Posrank

ExitRule: EndOfMonth and (!canhold or Posrank > worstrank)September 12, 2023 at 9:42 pm #115795Nick Radge

KeymasterLooks okay and not too dissimilar to what I initially posted.

You can probably tighten the code up, i.e.

Reggie1: Extern($#NYSEHL, C > MA(C,20)) // Regime Filter – NYSEHL

Reggie2: Extern($$SPX, C>MA(C,200))

ReggieCombo: Extern($#NYSEHL, C > MA(C,20)) or Extern($$SPX, C>MA(C,200))June 2, 2024 at 2:56 pm #115796RobertKinnell

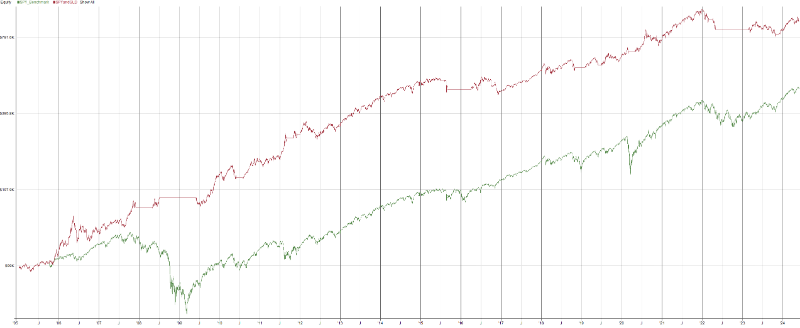

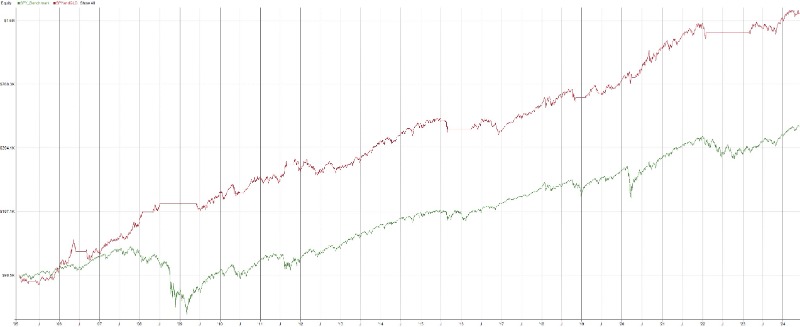

Participant12.6% ROR, 22% maxDD and AvgExp 79%.

And with QQQ instead of SPY…. 15.7% ROR, 20.5% MaxDD and AvgExp 79%.

June 11, 2024 at 3:16 pm #116169

June 11, 2024 at 3:16 pm #116169ArthurHill

MemberInteresting….thanks for sharing.

Nasdaq stocks account for around a third of the S&P 500 and there is an equivalent indicator for the S&P 500. #SPX52HL

-

AuthorPosts

- You must be logged in to reply to this topic.