Hi, I am hoping someone can help me with how the combination of different systems produces a sum greater than the parts. I was reading this article at allocate smartly

https://allocatesmartly.com/meb-fabers-12-month-high-switch/

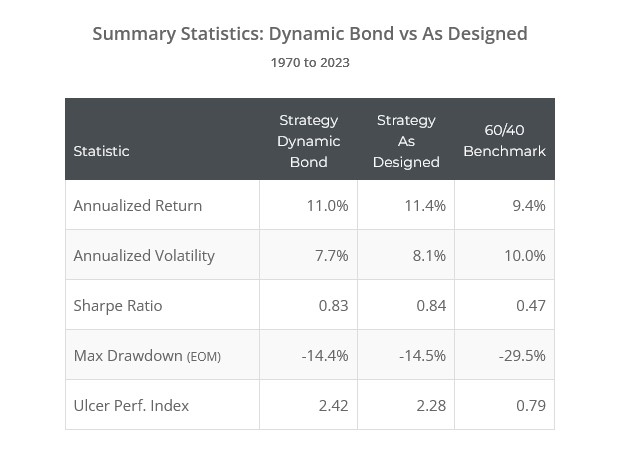

The two tables that sum it up are attached. When the strategies are tested individually they have cagr of between 7 and 10 but combined it is 11. Initial thoughts (for the uneducated) is that the sum total couldn’t be higher than the max cagr of any individual strat….but this would assume separate equity pools I suspect. Is this “magic” based essentially on have a combined equity account such that has a smaller max DD (based on diversity of assets and timing of poor performance being different) than any individual strat (so essentially still only getting the 7-9% returns from each strat but it is beginning each time from a “higher” starting point) ?