Home › Forums › Trading System Mentor Course Community › Trading System Brainstorming › Canada Market

- This topic is empty.

-

AuthorPosts

-

November 2, 2022 at 6:17 am #102222

KateMoloney

ParticipantResearching the Canada market for the ASX weekly swing strategy (with tweaks). Will start with a very small account and take a conservative approach.

Nick mentioned odd lots, which have the potential to impact your purchase price (see below).

https://www.tsx.com/trading/tsx-venture-exchange/order-types-and-features/order-types

Mixed Lots

An order that is mixed (with both a board lot and odd lot portion) is effectively split into two separate orders at the time of entry. The board lot portion trades normally in the Central Limit Order Book (CLOB) and the odd lot portion is treated as an odd lot order.

Odd Lots

Orders with volume less than a standard trading unit are considered Odd Lot and do not trade in the regular Central Limit Order Book (CLOB).On TSX Venture, Venture Odd Lot Dealers (VOD’s) perform auto execution of Odd Lots. The VOD automatically guarantees a complete fill at the TSX Venture Best Bid or Offer for Odd Lot orders priced at or better than the opposite side’s best price. If the Odd Lot order’s price is not marketable (or if there is no VOD) the Odd Lot order is displayed in the Odd Lot book and is eligible to trade continuously at its limit price (without regard to the CLOB price) and will trade at that price if an opposite side Odd Lot order is entered with the exact same volume priced at or better than the resting Odd Lot order’s price, OR against the VOD if the opposite side TSX-V Boardlot lot quote becomes equal to or better than the oddlots limit price. Odd Lots only trade as “All or None” which means partial fills are not accepted. It is possible for the Odd Lot book to display orders with overlapping prices when resting Odd Lot orders can match on price but not on volume.

MOC Orders

To participate in the Market On Close (MOC) match at 4:00 pm, MOC Mkt orders must be entered by 3:40 pm. All MOC orders before 3:40 pm must be market orders. Offsetting MOC Limit orders can be entered to satisfy the imbalance published from 3:40 pm until 4:00 pm. TSX/V will then calculate the closing price and publish MOC trades at 4:00pm unless a 10 minute extension is required in which case the extension is disseminated at 4:00pm and the MOC trades are published after the extension period concludes at 4:10pm.

Standard trading units (also known as “board lots”) are based on the security’s previous day per-share closing price on the TSX or TSX Venture:

Security’s Closing Price

Standard Trading Unit

Under $0.10 1000 shares

$0.10 and less than $1500 shares

$1 and up 100 sharesConvertible Debentures$1000 face value*As defined in UMIR

Booklet by TSX

https://www.tsx.com/ebooks/en/order-types-guide/2/

Comms November 2, 2022 at 9:21 am #115163

November 2, 2022 at 9:21 am #115163BenOsborn

ParticipantInteresting. Just goes to show you really need to look closely at how any new market that you enter operates. I would have just assumed that most major markets operated in a pretty similar fashion.

November 2, 2022 at 11:26 am #115170KateMoloney

ParticipantFor sure Ben. That’s why I am starting with a small account.

There is also another currency to hedge.

And also the weekly buy/sell process to think about. At this stage I’ll probably use manual MOC orders – input on a Friday afternoon local time.

Only thing I haven’t yet thought of is how to deal with any stocks bought during Friday day (before 11am Friday Canada time).

November 2, 2022 at 10:27 pm #115171TerryDunne

ParticipantI was tentatively considering cancelling unfilled orders at the same time I put in the MOC orders for open trades…I don’t think there is anything special about 11.00am?

I might miss some trades, but the opportunity in Canada appears so attractive at this stage that I’d rather get most trades than struggle to get all trades.November 2, 2022 at 10:43 pm #115172KateMoloney

ParticipantNick/Craig, why was the weekly system designed to cancel orders at 11am local time on Friday?

Is it because price movements in one day didn’t add much value to the system? and adds commission drag?

November 2, 2022 at 11:08 pm #115164JulianCohen

ParticipantFor what it’s worth I have mine set to allow trades on the Friday and to close at 4am on Friday afternoon. That’s how I backtested it

As far as odd lots are concerned…is it worth backtesting and trading in round lots so it fits the TSX criteria. That way there’s an ease of fill which in practice I see as a potential discrepancy between the backtest and reality. Why create that problem if you can overcome it initially…

November 2, 2022 at 11:42 pm #115165JulianCohen

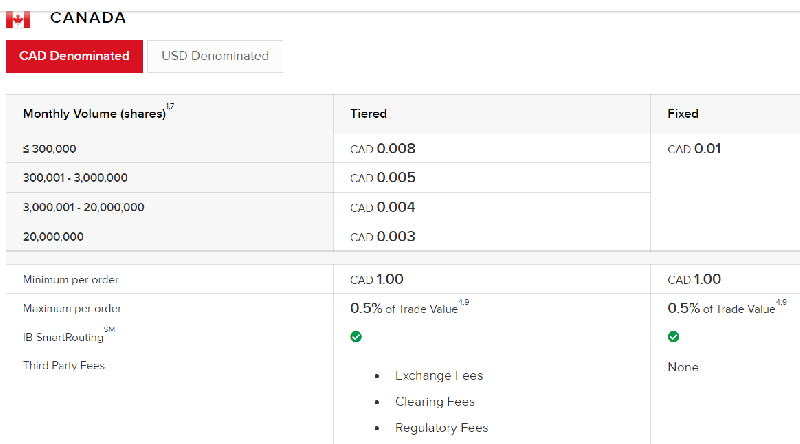

ParticipantWhat IB Commission formula are you guys applying to the TSX?

November 2, 2022 at 11:47 pm #115173Nick Radge

KeymasterWell, there’s only so far the market can move in a single day. I set it for 11am so you’d get any large opening gap but from then on I couldn’t see the point.

November 3, 2022 at 12:39 am #115175JulianCohen

ParticipantGood point

November 3, 2022 at 1:55 am #115174TerryDunne

ParticipantHi Julian,

Do you have access to intra day data?

Completely agree re odd lots – just make the order size fit into their ‘standard’. While this will need to be tested, you’d imagine that the swings and roundabouts would roughly even out…

November 3, 2022 at 1:58 am #115176TerryDunne

ParticipantHi Nick,

By my reckoning, 11am Canadian is 2am (3am after this weekend) Sydney time?

November 3, 2022 at 2:45 am #115177Nick Radge

KeymasterTerry Dunne post=13533 userid=719 wrote:Hi Nick,By my reckoning, 11am Canadian is 2am (3am after this weekend) Sydney time?

LOL…think about that one mate

November 3, 2022 at 4:47 am #115178TerryDunne

ParticipantI think I don’t like it. I’m not getting up in the middle of the night every Saturday to place and cancel trades. The very idea makes me LOL.

Hence my thought that I’ll simply cancel unfilled orders and place MOC orders for open positions on Friday (local time).

I get that this will not be a complete match to back tests, but nor would an 11am cutoff. My expectation is that trades initiated on Friday will be fewer and less profitable than trades earlier in the week?

November 3, 2022 at 5:41 am #115179Nick Radge

KeymasterThe strategy was built for the ASX, hence the 11am cancellation time. However, even if it were 11am for the Canadian market, it can be done using Basket Trader.

November 3, 2022 at 5:50 am #115166JulianCohen

ParticipantTerry if you use batch trader then it will cancel the trades for you, you can also set it to place closing trades so it is all automated. I have been told that API trading is not allowed on the TSX so batch trader is the way to go.

I tested using round lots and it made very little difference so I’m going to look at using it.

I used 0.1 to 1.00 500 share

over 1.00 100 sharesI’m excluding anything below 0.1

-

AuthorPosts

- You must be logged in to reply to this topic.