Home › Forums › Trading System Mentor Course Community › Trading System Brainstorming › Mean Reversion – June 2022

- This topic is empty.

-

AuthorPosts

-

July 2, 2022 at 1:39 am #102219

JulianCohen

ParticipantAs we have all had a kick this month in day trading strategies, I thought it might be an idea to make a separate discussion for future reference…Easier to find later on.

July 2, 2022 at 1:47 am #114883JulianCohen

ParticipantPersonally speaking I am not going to make any changes to my strategies this month. Won’t stop me from doing R&D but I won’t change anything operationally.

It would seem that everyone that is trading an MR/MOC or a daily strategy of some sort lost money this month. In fact for me it is since April that the slow drawdown has begun, rapidly increasing this month. The fact that no one on this forum has made money, and in other forums I am in I see the same thing, indicates to me that this is just a glitch in the Matrix and the market will revert to usual behaviour at some point. Nick’s investigations seem to reveal the same thing. This month the market is different, and has been different day after day which has meant our strategies can’t apply their edge. If I don’t see a reversion back to normality in the next couple of months then I will change my mind, but until then I will carry on carrying on.

I don’t want to try to investigate coding out this behaviour for the future too seriously, at the risk of overfitting my strategies.

July 2, 2022 at 3:12 am #114892GlenPeake

ParticipantYep…. I agree Julian.

The fact that so many different systems developed by numerous systematic traders on this forum (and other forums)…. are all in a similar situation, speaks volumes.

July 2, 2022 at 3:28 am #114893Nick Radge

KeymasterI suggest everyone retest their strategies back to 1997, specifically 27th October 1997 – the start of the Asian currency crisis. While the bounce was just as spectacular, you should see a similar depth of drawdown to what is being seen today

July 2, 2022 at 4:01 am #114894GlenPeake

ParticipantNick Radge post=13164 userid=549 wrote:I suggest everyone retest their strategies back to 1997, specifically 27th October 1997 – the start of the Asian currency crisis. While the bounce was just as spectacular, you should see a similar depth of drawdown to what is being seen today

For me my MR systems drop about 13-15% on that one day of 27th OCT 1997…. yeah the recovery was swift.

For me the current market/drawdown on my MR systems looks similar to the 2001-2002 period…. (drawdown was a little more back then).

July 2, 2022 at 4:23 am #114895JulianCohen

ParticipantInteresting…I have a -25% DD on 27th October followed by a 32% Profit the next trading day.

That kind of falls in line with other big down days followed by big up days.

So far we are all waiting for the big up day this time

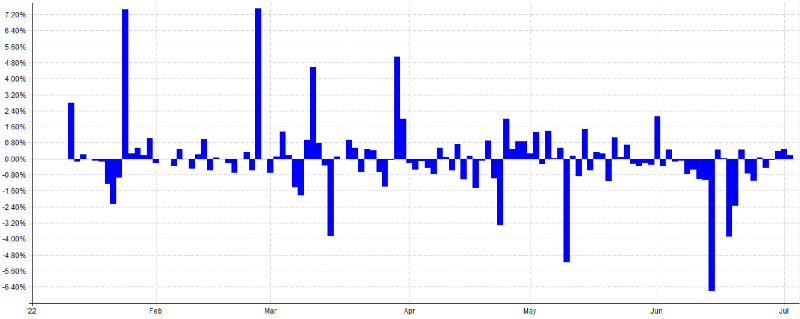

This is actual daily returns for this year. The big downs don’t have a big up after them

July 2, 2022 at 5:00 am #114896TerryDunne

ParticipantWow, that’s a great example Nick. While every trade taken on 27/10 was a loss, for the month the profit was HUGE.

This is my biggest concern about choosing not to trade…am I about to miss one of the few days that make an entire year? We’re never going to miss the big down days because the other factors in our life aren’t going to get in the way when we are making bank.

July 2, 2022 at 10:16 am #114884SladeChisholm

ParticipantMy MR MOC daily returns are similar to Julian’s, although I started in Apr so missed the first 3 months of the year.

To me it seems the up days since April haven’t had a dip intraday to satisfy the stretch so I’ve sat on the side lines.

The drawdown on 27 Oct 97 was -9.1% followed by a 16.9% gain next day.

Current DD is still ahead of B&H…….happy to carry on.

July 4, 2022 at 8:01 am #114885SaidBitar

MemberI tested my system starting on 95

27/10/97 the daily return was -16% followed by +40%

regarding DD, the current DD is the deepestJuly 4, 2022 at 11:08 pm #114905Nick Radge

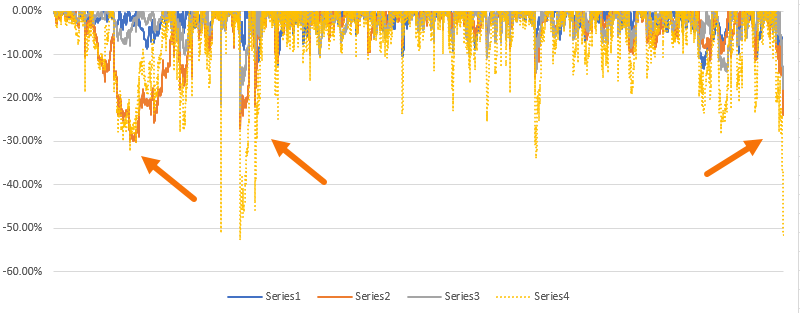

KeymasterMy MOC is made up of 3 setups. Yesterday I stripped each out separately and looked at the drawdowns of each and also combined. The chart below is a little hard to decipher, but Series 1, 2 and 3 are the individual setups and Series 4 is the combined. What is obvious is that setup #2 tends to have larger drawdowns and slower recovery rates. It has the highest CAGR of the 3, but also the worst drawdown and the lowest MAR.

I might spend today optimising the position sizing.

Another interesting fact that may appeal to others, is the combination of all setups have a higher MAR than each individually.

Setup #1 = 1.60

Setup #2 = 1.51

Setup #3 = 1.65

Combined = 2.76 July 6, 2022 at 2:23 am #114908

July 6, 2022 at 2:23 am #114908TimothyStrickland

MemberThat is interesting. When you say combined MAR from combining all setups, I am assuming you mean you have 3 different entry criteria that could trigger a trade based on 1 of those criteria, until you run out of trades or the criteria must meet all 3?

July 6, 2022 at 2:35 am #114914TimothyStrickland

MemberI have been doing some research on why my MRV took such a hit. I went back through my notes and noticed that I initially tested this with 20 stocks on the S&P but then changed it later to only use 10 stocks because I got a higher CAGR with some added drawdown. I went back and tested the system very far back (the one with 10 stocks) and the drawdowns were much worse than I thought, I did not test that far back when I initially made the system. I actually re-tested the same MRV with 20 stocks over the last 3 years and it outperformed the one with 10 by 40% CAGR!! Additionally, the drawdown wasn’t nearly as steep in the last couple of months. I would have likely still been trading it.

When I initially built my systems they were not geared for a good MAR or even took drawdown into consideration as much. I was more focused on making a large CAGR and that worked out well for 2020 when the market was screaming and my systems performed 250% combined. Fast forward to 2022 and my systems took massive hits because drawdown just wasn’t my focus back then, I didn’t have much money in those accounts. Now that my accounts are quite large, I really have to focus on preserving capital. Luckily I turned them off before June hit which saved me a lot of pain. Now its time to focus on preservation rather than growth.

July 6, 2022 at 5:21 am #114915JulianCohen

ParticipantI think the best bit about your story is that you didn’t blow up, so even though you took a hit, you are still there to go for the next round.

It took me a long time in my backtesting journey, but once I realised the the CAGR was pretty much always going to be different than the actual, mainly due to trades not hit for whatever reason (I’ve had a number of missed trades the last few days from lows of the day being my limit price – they rarely get filled), I worked a lot more on keeping the MDD as low as I could, whilst the CAGR was still good. Then in my head I’m thinking that whatever I see as an MDD in backtesting will at some point in the next few years be half what the real MDD will be.

That at least sets the mental framework for me for trading.

July 6, 2022 at 2:19 pm #114916TimothyStrickland

MemberGood point Julian,

Luckily I am still in the game and will keep trading, I just have to re-think how things are done going forward. Especially in light of my mistake AND the fact that the market can really go haywire like it did in June. Unfortunately, testing has its limitations as you pointed out. I am finishing up school so I can really start to focus on what I want to do which is trading and writing software to support that goal.

July 6, 2022 at 9:24 pm #114917KateMoloney

ParticipantJulian Cohen post=13190 userid=5314 wrote:I think the best bit about your story is that you didn’t blow up, so even though you took a hit, you are still there to go for the next round.It took me a long time in my backtesting journey, but once I realised the the CAGR was pretty much always going to be different than the actual, mainly due to trades not hit for whatever reason (I’ve had a number of missed trades the last few days from lows of the day being my limit price – they rarely get filled), I worked a lot more on keeping the MDD as low as I could, whilst the CAGR was still good. Then in my head I’m thinking that whatever I see as an MDD in backtesting will at some point in the next few years be half what the real MDD will be.

That at least sets the mental framework for me for trading.

Great share Julian.

Craig gave me a bit of code that excludes the low of the day. So when I run my back tests I do the “normal” back test, then I exclude the low of the day to get a more realistic picture.

-

AuthorPosts

- You must be logged in to reply to this topic.