Just wondering if someone can offer a suggestion(s) in terms of determining a more definitive way of assessing ticker code correlation between 2 similar systems.

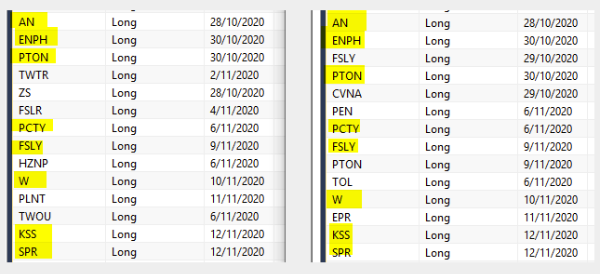

i.e. I have 2 MR systems and want to determine whether adding a 3rd system will target/trade similar ticker codes or not…. of course I could just eyeball the backtest ticker codes output and get a ‘feel’ for whether each system is just hitting the same ticker codes or not, but I was hoping for a more definitive %… i.e. a breakdown month by month of the % of similar ticker codes traded etc.

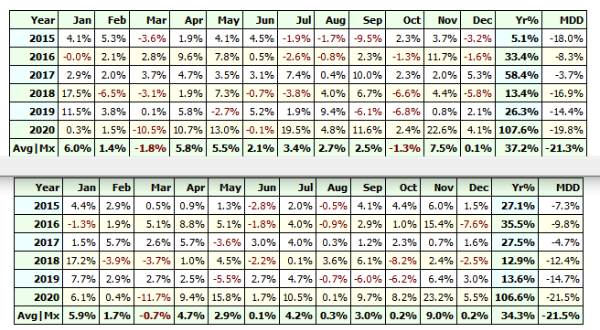

Just looking at a 5 Year backtest report and comparing the 2 systems shows, there are months where the % gain/loss are similar and there are also months/years where there is an obvious difference etc…

I quick eyeball shows a bit of a sample of similar ticker codes highlighted etc.

(I’m not sure if this is something that REALTEST might be able to offer???)

Any ideas from the Brains Trust??