Home › Forums › Trading System Mentor Course Community › Trading System Brainstorming › Incorporating an Index Volatility Based Trailing Stop with the WTT

- This topic is empty.

-

AuthorPosts

-

April 27, 2020 at 5:34 am #102018

GlenPeake

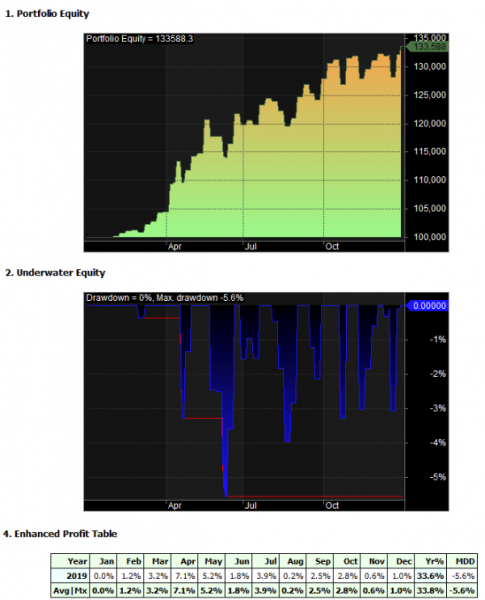

ParticipantSince going like with the Weekend Trend Trader (WTT) in January 2019, I thought I’d look back to see how things performed

The real-time live traded, Out-of-Sample data for JAN2019 – DEC2019, looks quite good, obviously the WTT was hooked up nicely and ‘In-Sync’ with the market.

So, some pretty solid returns.

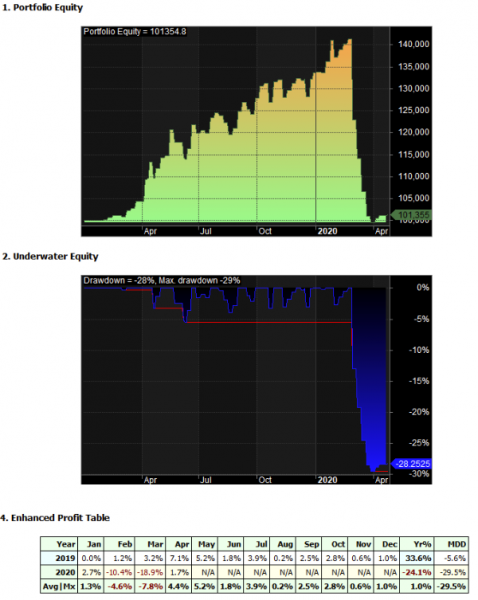

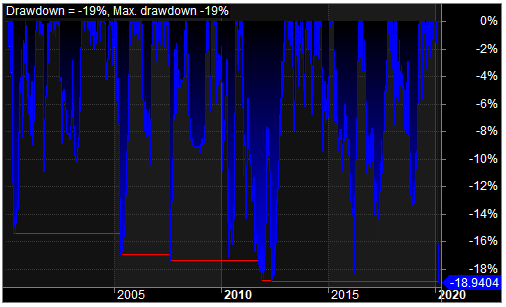

Obviously things were looking good, up until FEB/MAR when things turned downward.

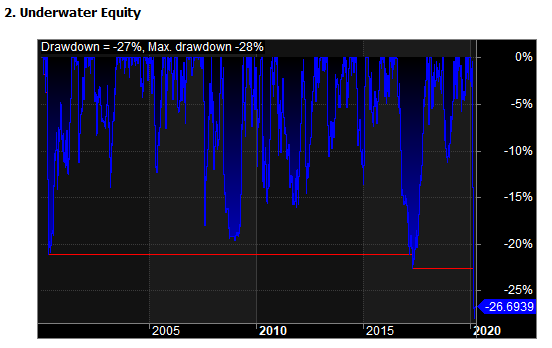

Some pretty steep drawdown…. to say the least.

So, I decided to take another look at things around the trailing stop/exit……

The default WTT specs uses the following trailing stop/exit:

Initial stop with Index Filter UP/Green: 40%

Index Filter Down/Red: tighten the trailing stop up to 10%My current WTT build uses the following trailing stop/exit:

Initial stop with Index Filter UP/Green: 40%

Index Filter Down/Red: (wider than the 10% default) tighten the trailing stop up to W%The wider trailing stop enables more wiggle room to keep me in trades longer which translates into bigger % returns i.e. I see more of the plus 200% returns with the wider trailing stop….also better CAR/MDD

However, the speed of the recent downtown meant the trailing stop of some of the positions were tagged earlier in the week, I’d then have to hold until the exit signal was generated on the Friday evening before then placing the Sell order on the open for Monday where the position was generally well below the trailing stop, (I was also experiencing slippage on the open, due panic selling etc).

So, I’ve been testing alternative combinations of ‘hybrid volatility’ trailing stops….

The “Hybrid Volatility” trailing stop, at a high level works like this, I still use the default 10MA to measure the UP/DOWN Index Filter status and then IF the Index is DOWN, I measure the volatility of the Index and if NORMAL, do nothing with the trailing stop i.e. just leave it at the normal INDEX Filter DOWN level. But if the INDEX filter is DOWN and the VOLATILITY is HIGH, then tighten the stop even more….

Initial stop with Index Filter UP/Green: 40% (same as above)

Index Filter Down/Red, Index Volatility Normal: (wider than the 10% default) tighten the trailing stop up to W%

Index Filter Down/Red, Index Volatility HIGH: tighten the trailing stop even higher to X%

Here’s what my current testing is showing…..

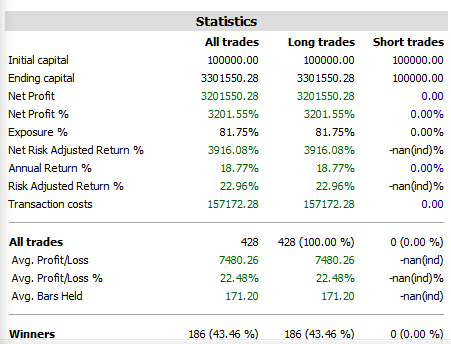

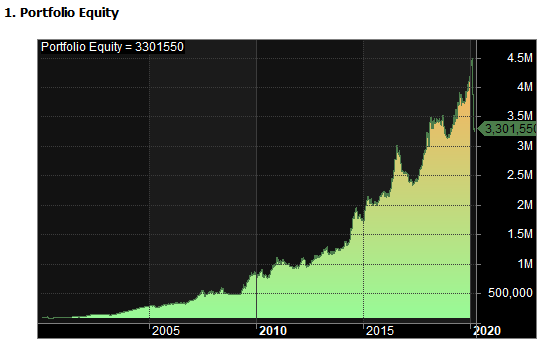

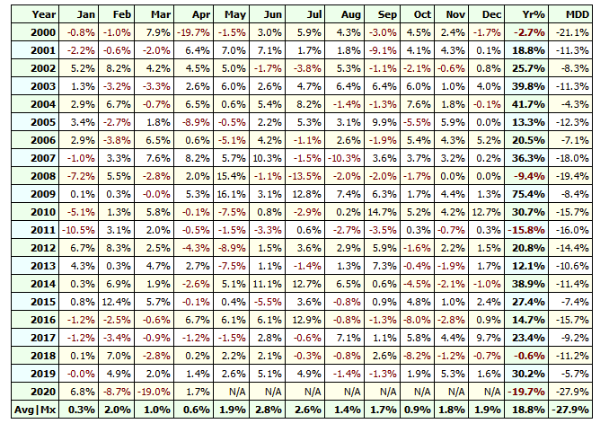

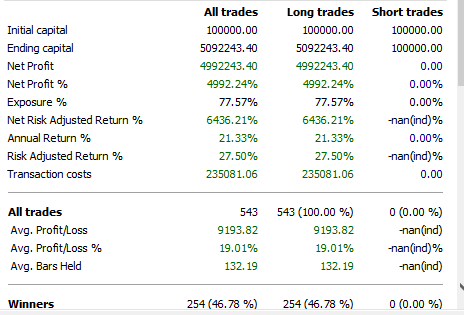

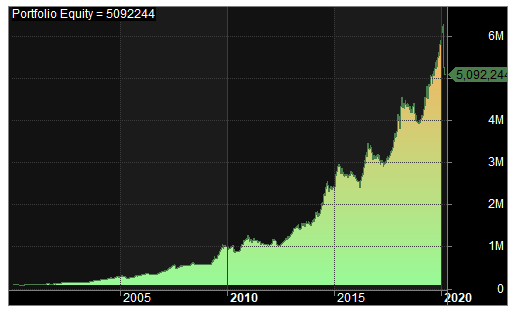

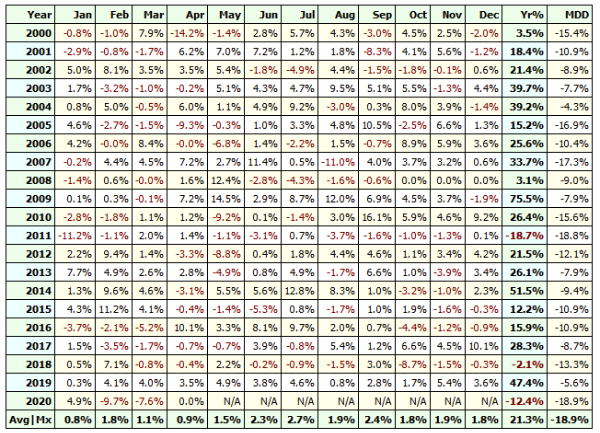

20 Year Backtest

Without the Hybrid Index VOLA check (Current WTT Code):

…. continued in the next post…..

April 27, 2020 at 5:38 am #111335GlenPeake

ParticipantWith the Hybrid Index VOLA check: (Currently Testing)

Thoughts / comments?? Positive / negative……. Am I curve fitting..? Am I suffering from Recency Bias…. do I need a ‘sanity check’ :cheer:

April 27, 2020 at 7:31 am #111338ScottMcNab

ParticipantGreat results

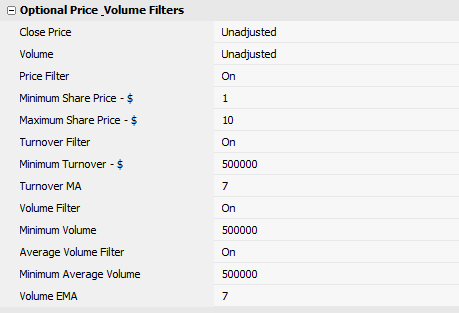

You know what I am going to say…give it a run on something else…SPX ? If filter has same sort of benefit it gives some comfort that not just curve fitted to ASX history (notwithstanding correlation between the two)PS tell me you’re not using turnover filters or using very loose ones ? Or do these results include dividends? Give me something to hold on to as I look for excuses as to why I am not getting these kinds of results…

April 27, 2020 at 7:52 am #111339GlenPeake

ParticipantScott McNab wrote:You know what I am going to say…give it a run on something else…SPX ?Haha… yep, I may have anticipated that one.. it’s good advice and something that I had already looked at on the R3000…

Stats are in the ballpark…. Car 18 / MDD 31

All of the stats are EXcluding dividends.

April 27, 2020 at 7:57 am #111340

April 27, 2020 at 7:57 am #111340GlenPeake

ParticipantScott McNab wrote:PS tell me you’re not using turnover filters or using very loose ones ? Or do these results include dividends? Give me something to hold on to as I look for excuses as to why I am not getting these kinds of results…These are the Filters for the R3000. For the ASX WTT the only difference is the MIN Price, which I have set to 0.50 (fifty cents)…. no dividends included…

April 27, 2020 at 8:13 am #111341

April 27, 2020 at 8:13 am #111341ScottMcNab

ParticipantThese are the Filters for the R3000. For the ASX WTT the only difference is the MIN Price, which I have set to 0.50 (fifty cents)…. no dividends included…

[/quote]

Damn [strike]you[/strike] it…must be something corrupt in my database..gotta be

April 27, 2020 at 8:20 am #111342

April 27, 2020 at 8:20 am #111342GlenPeake

ParticipantHaha….

Funny you should mention that…..I kid you not, I had a corruption in my Norgate Database not so long ago and had to create a new database…… Symptom was, it was taking 15 minutes to run an EXPLORE…..

April 27, 2020 at 8:23 am #111343Nick Radge

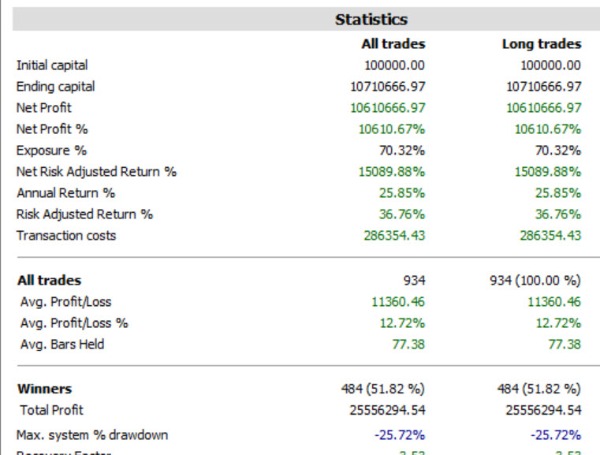

KeymasterMight need to test it on the Radge tricked up version…can’t have you whipper-snappers getting ahead of the curve.

April 27, 2020 at 8:42 am #111345

April 27, 2020 at 8:42 am #111345GlenPeake

Participant…..and then the guy in the TESLA pulls away and you’re left eating electric dust….. lol

Nice numbers Nick….very nice!!!. 51% win rate as well…. 70% exposure…-25% MDD….. That’s one tricked up puppy!!!!

April 27, 2020 at 11:43 pm #111344

April 27, 2020 at 11:43 pm #111344ScottMcNab

ParticipantGlen Peake wrote:Haha….

Funny you should mention that…..I kid you not, I had a corruption in my Norgate Database not so long ago and had to create a new database…… Symptom was, it was taking 15 minutes to run an EXPLORE…..

Pad and Align was ticked :whistle: :whistle:

Going to be trouble when I find out which one of the kids is responsibleApril 28, 2020 at 12:10 am #111349GlenPeake

ParticipantScott McNab wrote:Pad and Align was ticked :whistle: :whistle:

Going to be trouble when I find out which one of the kids is responsible….go easy on them, they were probably just preparing for the next “Intra Family Stock Picking Competition” :whistle:

….. I think I recall in a past post you mentioning they have good form with their picks!!!! :cheer:

April 28, 2020 at 2:20 am #111336ScottMcNab

ParticipantYes…buy and hold on a few top stocks on SPX was hard to beat last year

another reason 👿May 13, 2020 at 5:37 pm #111350BenJeffery

MemberHey all, the WTT seems to have a cult following around here. Coded it up from the rules on thechartist website.

Tried to replicate the results below on the Russell 3000.

https://www.thechartist.com.au/product/weekend-trend-trader-amibroker-code/Could only pull a 12.7% return and 33% drawdown with dividends on.

No mention of any ranking so left PositionScore empty.

Used h==hhv(h,20), spx as the index filter and used C not L of prior bar as exit trigger, applied all price and volume filters.Can’t see where else you’d get tripped up, but could have botched it somewhere.

Is the base code available to us all or are you coding it up yourselves?May 13, 2020 at 9:06 pm #111428Stephen James

MemberHi Ben

The lookback period for HHV includes the last bar of the data (if coded as last bar). HHV creates the channel so a breakout must be above the channel.

e.g. H > Ref(HHV….May 14, 2020 at 4:25 pm #111430BenJeffery

MemberThanks Craig.

Using H > Ref(HHV(H,20),-1) gives me 11.8% with drawdown of 31%.

Is there a default PositionScore I should be using? -

AuthorPosts

- You must be logged in to reply to this topic.