Home › Forums › Trading System Mentor Course Community › Progress Journal › Seth’s Journal.

- This topic is empty.

-

AuthorPosts

-

April 9, 2020 at 3:33 pm #102003

Anonymous

InactiveI have finished the course material [strike][mostly]and am now onto system creation.[/strike]

To-do list:

[strike]Nick’s “flip a quarter” course quiz[/strike]

never did it, bad influence if any newcomers are reading[strike]Where NR is putting his money in 2020 video[/strike]

[strike]Take the deep dive and start coding everything instead of looking at charts[/strike] — [strike]Coding like a boss[/strike] 13-April-20

[strike]Same day edit: more like a helpless puppy[/strike]MOC system creation

[strike]* entry criteria[/strike] 13 Apr 2020

[strike]in progress[/strike] 24 April 2020

[strike]I think I’ve done it.[/strike]

Went live today 18 May 2020.[strike]I have enough [too many] ideas that I am going to see if I can build a second one that is not too correlated.

[/strike]

Done and would like a short system to go with it…[strike]Long term TF system for 401k creation[/strike] Live 1 July

[strike]Get IBKR to approve my account[/strike]

Done. Early May.

[strike]

Investigate ATR based volatility filter that I saw Tim mention a few times[/strike]

Yep, cool. I like it. 24 April 2020[strike]Crack open Howard Bandy’s Practical Methods for Swing Trading book[/strike]

Slow down dude… every bit of code is optimized. Not a fan of that method. I can barely convince myself to use .31 instead of .3 as a multiplier… just seems too…. fitted.[strike]Test JB Marwood Simple Pullback Strategy on 3x leverage ETFs[/strike]

Need to make some ETF related strategy for my health savings account (like a retirement account for health insurance)[hr]

[strike]Sell my small business[/strike]

Happened on 2 Nov 2020Start new career

*longer term

Just got my resume finished, Dec 30 2020

[hr]April 9, 2020 at 9:26 pm #111251Anonymous

InactiveWow, after staring at a screen for 4 hours I have created my first loop from scratch. I started with attempting to use *-1 on a predefined variable for “# of up days in a row” because my brain wanted to count backwards, and I ended with a nice concise for statement and some minimalist if else statements. While I am slightly happy about this, I coded it without the loop first in about 1 minute and then spent the next 240 of them wondering if it was even necessary to complete the loop.

Hah!

Quarantine life, am I right?Edit 10 April:

Turns out that I could have done it all with a simple SUM function. Well, live and learn! Thanks Craig.April 24, 2020 at 4:28 pm #111262Anonymous

InactiveA few weeks of quarantine and I think I have a system that can actually be traded. The key was, to nobody’s surprise here that listens to Nick:

Go more simple, more simple, more simple. I have distilled the system to fool-proof.May 18, 2020 at 11:16 pm #111333Anonymous

InactiveFirst trading day today with my first system. Yesterday I was… apprehensive and irritable.

Thankfully, Nick offered to walk me through execution on zero day.At one point last night, before I went live, I had to tell Nick to get off of my teamviewer because it felt like dad was watching over my shoulder. Dang, I was a nervous wreck!

It was a down day. I bought Wayfair (W) which had a big big loss. Oh well – on to the next one!

May 19, 2020 at 1:24 am #111463GlenPeake

ParticipantWell done Seth!!! I wondered why the DOW put on 900 points

For what it’s worth….. My first system (MOC) went live in OCTOBER 2018…. :ohmy: You’ll know what I mean when you look through your backtest reports and charts!!!

May 19, 2020 at 2:38 am #111464

May 19, 2020 at 2:38 am #111464ScottMcNab

ParticipantCongrats on the milestone Seth

May 19, 2020 at 8:52 am #111468MichaelRodwell

MemberYou’ve got the touch Seth.

I tanked the market on my go-live.

May 19, 2020 at 7:08 pm #111467

May 19, 2020 at 7:08 pm #111467Anonymous

InactiveGlen Peake wrote:Well done Seth!!! I wondered why the DOW put on 900 points

For what it’s worth….. My first system (MOC) went live in OCTOBER 2018…. :ohmy: You’ll know what I mean when you look through your backtest reports and charts!!!

Ah yes, I have noticed that big blue underwater riptide there, an echo from earlier in the year it looks like! Seems as if it almost has the letters “trump” written in it… Oh, what’s that little echo I hear? Sounds like:

“Trade wars are good and easy to win”.Whatever. That’s why Rocinante [yes, I named the system] doesn’t care about the news. Good thing one of the two of us isn’t upset by current events.

I just have to keep pressing the button.

Cheers to you guys. Thanks Scott and Michael and Glen.

May 21, 2020 at 12:42 am #111471TrentRothall

ParticipantAfter seeing your post on Wayne’s thread

Have you had any experience with A.I. or it probably can be without it tbh (i’m no expert). Would be great to be able to go over a backtest or potential setups and see what precedes the good or bad trades, bar, volume patterns etc. I guess i kind of looked a bit deeper into my system with the cbt to compare setups but there must be a better way.

May 26, 2020 at 1:31 am #111479Anonymous

InactiveHey Trent – I don’t have any experience with AI. That’s getting into some real programming there, and I am far, far away. The closest I’ve done is almost rented my GPU mining rig out for AI research, and that didn’t pay too well after all so I never pulled the trigger.

I think that AI-esque analysis could lead to a slippery slope of data snooping. Nick may have better information about what firms are doing it. I’m sure it is profitable for some, but I imagine that you would need lots of resources to create the analysis program, and the ones that have it working won’t tell you how to do it. Hah.

May 31, 2020 at 3:39 pm #111501Anonymous

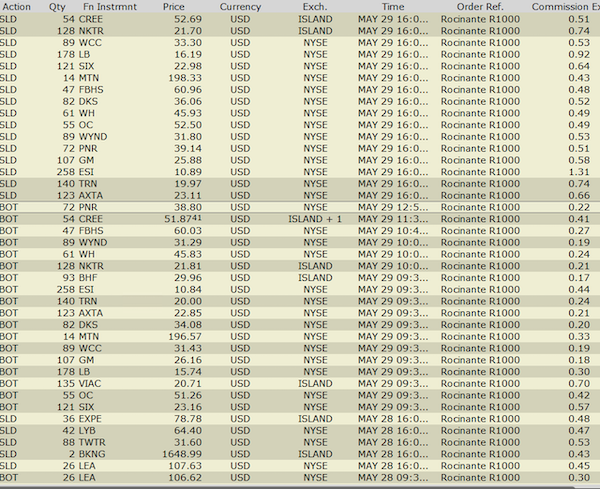

Inactive18th May – end of month

MOC

Rocinante – (10.3%)Cool!

Changed from fixed to tiered commission after the first week of trading and it made a huge difference for me. Maker rebates make a large difference for the entries, and I suspect that would be the case for any MR style system where you are entering with limits.

With fixed commission, I was paying exactly: (with ~$2500 USD per order)

$1.00 on limit entries

$1.06 or 1.07 on MOC exitsOn average, (and I didn’t actually spreadsheet and calculate this) with tiered commission, it looks to be (with ~$2800 USD per order)

1/3 as expensive on limit entries

2/3 as expensive on MOC exits

Leaving this here in case it helps someone else as well June 9, 2020 at 4:37 pm #111561

June 9, 2020 at 4:37 pm #111561Anonymous

Inactive32 out of 40 fills before 10am – it’s an easy way to get the next 1000 out of the way, that’s for sure.

June 9, 2020 at 8:56 pm #111615Anonymous

InactiveWatching the market while it runs? Too stressful for me. I’d rather just sleep and only look at the result after the close.

I had a few in the first few minutes, but then a burst of fills right around 10am. The rest pretty random through rest of day.

21 fills in total for the day. Absolutely picture perfect distribution. 13 greens, 8 reds. 18 Long, 3 short.

Nice and green finishing number for the day.

June 9, 2020 at 11:33 pm #111618Anonymous

InactiveI was also in the money on the close – but I’ve had a few of those in a row. I’ll give some back soon. I don’t typically “watch”, but I do peak. Quarantine life, you know.

July 5, 2020 at 8:36 pm #111252Anonymous

InactiveWow – what a freaking month! I’ve finally got a handle on some portfolio tracking and I sold some bitcoin to put my money where my mouth is for my strategy.

I also had some things become a bit more clear, namely, why I couldn’t figure why my returns looked so funny. Possibly starting with STT mid-month caused some hiccups for my last ROR calculation, so I’ve amended it above. It was much worse than I reported, at actually (10.3%)June:

Rocinante R1000 – 6.51%I have Nick’s Performance-Tables spreadsheet up now (https://edu.thechartist.com.au/kunena/progress-journal/519-cftc-performance-tables.html)

and I also turned on my NDX momo strategy. I’m going to trade it twice monthly, on the 1st and the 15th. I’ve thought about trading thrice, on maybe the 1st/11th/21st, or even in a four-week rotation, but I don’t really think there would be a substantial difference other than increased work load. -

AuthorPosts

- You must be logged in to reply to this topic.