Just curious how those that are running a Rotational system, specifically those that use the Worst Rank Held value e.g. you have a MAX of 5 positions and a worst rank held to e.g. 10 positions.

How do you process/rotate your stocks around, to ensure you don’t select the incorrect stock etc. I.e. how do you ‘idiot proof’ yourself from messing up and accidentally missing a stock inside/outside of the TOP 10 list?

E.g. do you manually ‘eyeball’ the stocks held in the backtest/portfolio and then run an explorer at the end of month and manually check the rankings to determine if the stock is still in the TOP 10 or not etc.

OR

Is there a more automatic/AFL code option that, ‘Idiot Proofs’ the process?

Example

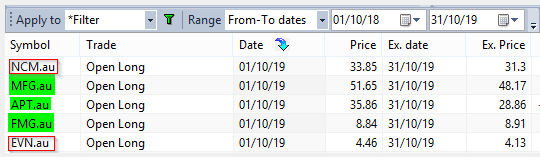

At the end of OCT 2019 I’m currently holding the following 5 stocks:

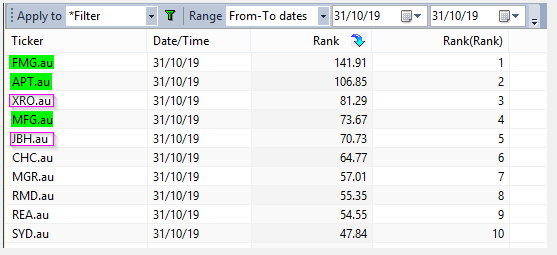

Upon running an Explorer at the end of OCT 2019, I’ve determined that NCM.au & EVN.au are no longer in the TOP 10 and will be sold off and rotated out and replaced by 2 new stocks: XRO.au & JBH.au

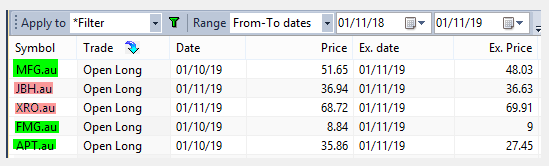

Then the following day I run a backtext on the 1/11/19 and confirm that we are all ‘in sync’…..and I haven’t messed up.

So how does everyone else manage this rotational process? Is it a manual eyeball like above or is there a better ‘foolproof’ method?

Cheers

Glen