Home › Forums › Trading System Mentor Course Community › Trading System Brainstorming › What Worked Well in 2021-2022? MOC System Brainstorming

- This topic is empty.

-

AuthorPosts

-

March 5, 2023 at 4:50 am #101875

GlenPeake

ParticipantWith tough trading conditions over the last 1-2 years….. I wanted to see what (could’ve) worked well (Harry Hindsight)….. from a MOC system perspective…. as a lot of the shorter term strategies that I trade or have developed have under performed….i.e. that statistics for 2021/2022 in the backtest reports were underwhelming. So as an exercise I was keen to know what ‘style’ of MOC system am I missing i.e. uncorrelated point of view…..

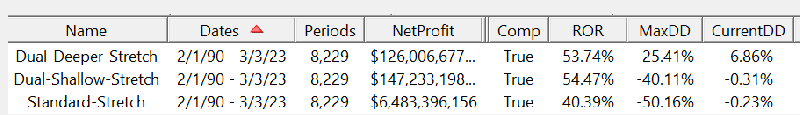

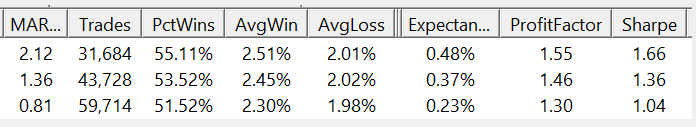

Here’s a MOC system with a few variations…. around the use of a single/dual shallow stretch/dua deepl stretch.

In general, the deepest drawdown periods are during 2008, late 2015/early 2016, 2020 and recovery out of drawdown is fairly quick. Drawdown can be limited more with a deeper stretch……

I came up with 3 additional MOC systems before this one worked ‘really’ well for the 2021-2022 period.

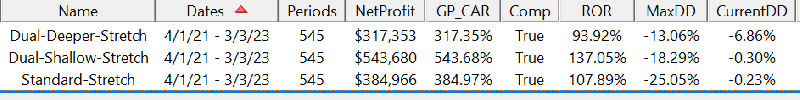

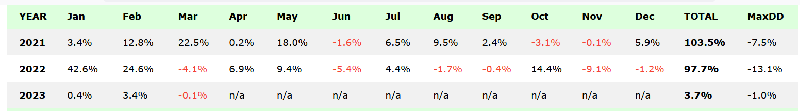

2021-Current

Stats continued:

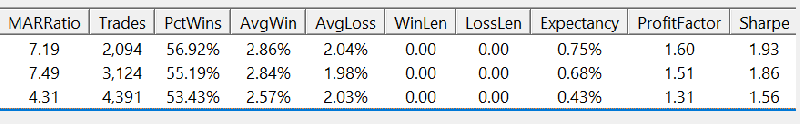

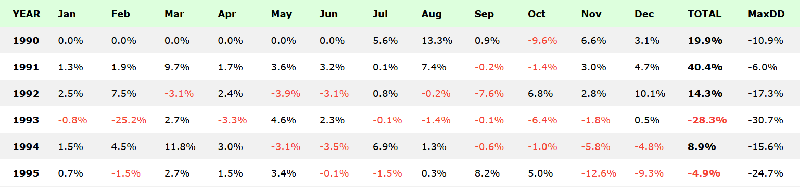

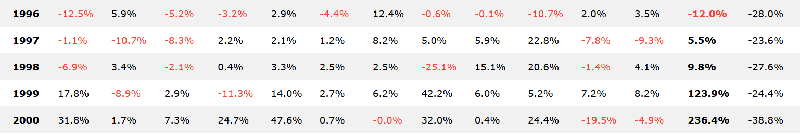

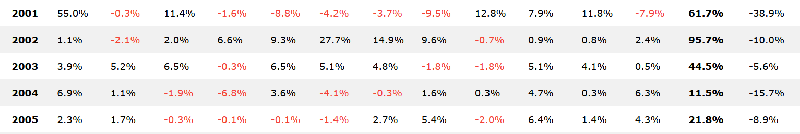

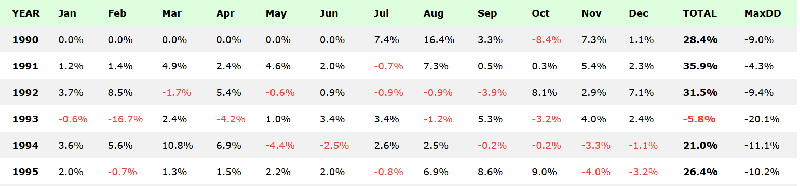

2005-Current

1990-Current

…….Monthly returns to be posted in the next post………

March 5, 2023 at 4:54 am #115474GlenPeake

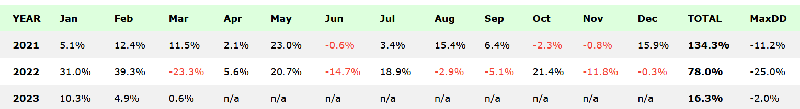

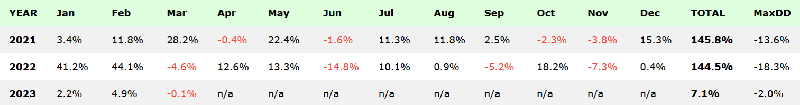

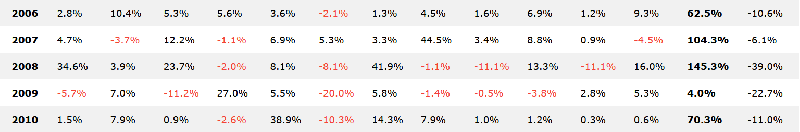

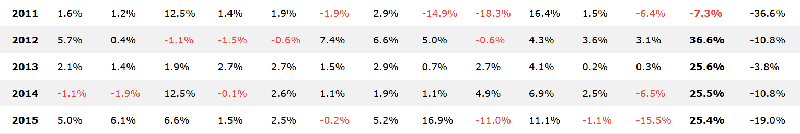

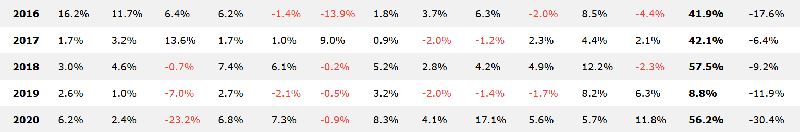

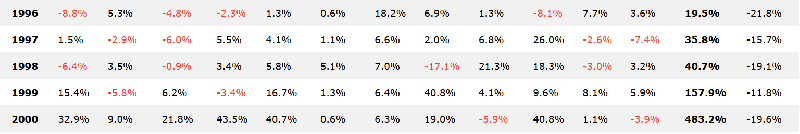

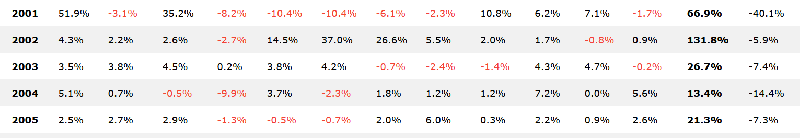

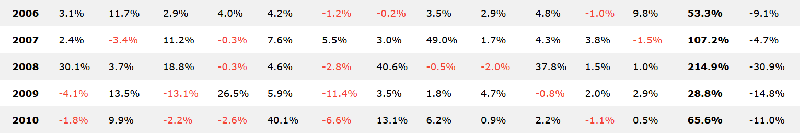

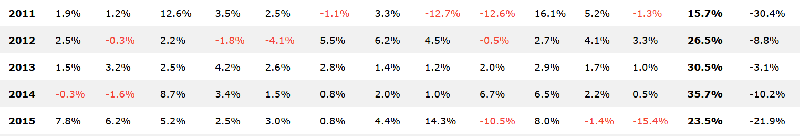

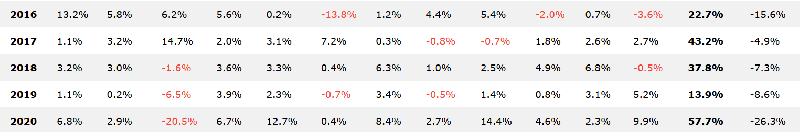

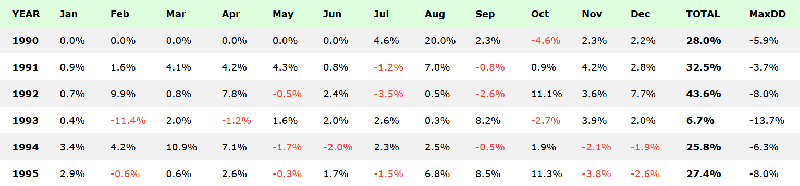

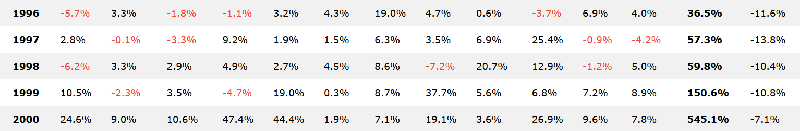

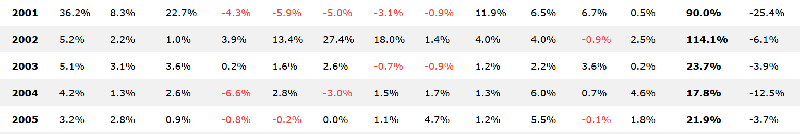

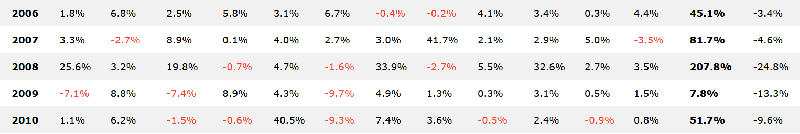

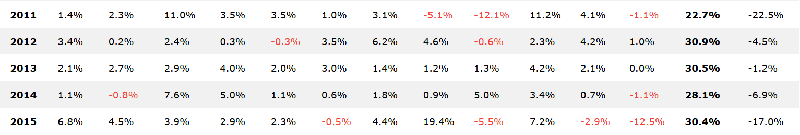

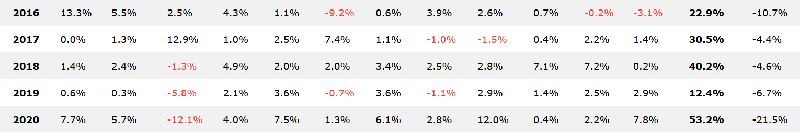

ParticipantMonthly Stats

Single Stretch

Dual Stretch Shallow

Dual Stretch Deep

The system entry is based on volatility and uses volatility to determine current market conditions and which stretch to use within the dual stretch option. It has a Min/Max price entry condition and a single Indicator entry condition…. very simple.

March 5, 2023 at 6:02 am #115475GlenPeake

ParticipantMonthly Stats

Single Stretch

March 5, 2023 at 6:04 am #115476

March 5, 2023 at 6:04 am #115476GlenPeake

ParticipantMonthly Stats

Dual Stretch Shallow

March 5, 2023 at 6:06 am #115477

March 5, 2023 at 6:06 am #115477GlenPeake

ParticipantMonthly Stats

Dual Stretch Deep

March 5, 2023 at 9:40 am #115478

March 5, 2023 at 9:40 am #115478BenOsborn

ParticipantThanks Glen, pretty impressive results over the last couple of years (and earlier).

Where the drawdown is larger in a couple of the earlier years, do you think that it is due to the parameters that make it so good in the recent years or is that fairly standard? (having the opposite effect then?)

I have been playing with MOC systems myself. I have developed 2 more but nothing I am going to trade as they are not too dissimilar to the stats of my current systems.

I have noticed that different ranking methods can change the drawdown profile and when they occur.

March 5, 2023 at 10:40 am #115480GlenPeake

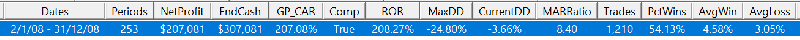

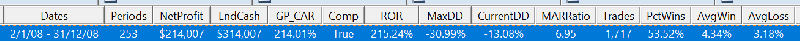

ParticipantBen Osborn post=13880 userid=5409 wrote:Where the drawdown is larger in a couple of the earlier years, do you think that it is due to the parameters that make it so good in the recent years or is that fairly standard? (having the opposite effect then?)Honestly, I think it is market related, as the DD’s occur when the rest market is crapping itself and all trading systems tend to cop a slap across the face during these times, you can’t avoid this…. If we take a quick look at the 2008 stats during the GFC where the Drawdown is the most…. and compare DUAL Stretch Shallow vs DUAL Stretch Deep.

The numbers during this period are slightly higher %Win, AvgWin% and lower AvgLoss% in the DUAL Stretch Deep variation. So small differences there, but definitely a lot less trades in the DEEP stretch variation as well… less fills as a result of a lower BUY Limit price etc, so where not suffering ‘death from a 1000 cuts etc’ burning up cash etc.

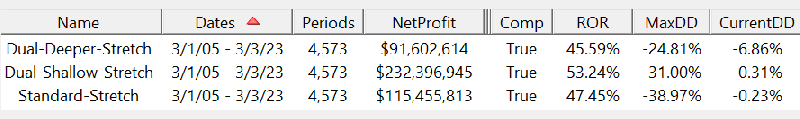

Deep Stretch Stats

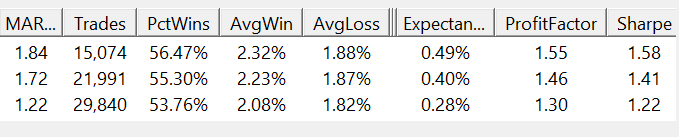

Shallow Stretch Stats

When I put the system together I focused on the 2021-2022 period as I wanted to try and get a system that actually made a decent return (it was bugging me and I wanted to find something that actually worked for this period

) and then once I had that, went further back in the sample period.

) and then once I had that, went further back in the sample period.I only tested the 1990-2005 period after I got the system to this point….. and I believe Nick mentioned in another post that the mid 1990’s is/was similar to the past couple of years in terms of market conditions. So when I tested that period, the system with the DUAL Stretch option, performs well/acceptable/passable etc…..Additionally, the year 2000 was another year where the returns were pretty amazing e.g. +400% and +500%…. these stats are what the backtest came back with…. (if only I had been trading the system back then

)

)I’m also using the same lookback period for my entry filter and ranking method…. so fairly consistent and simple from that point of view….

March 7, 2023 at 8:47 am #115481Nick Radge

KeymasterSort of along those lines, this is an interesting article about creating a benchmark for your mean reversion systems:

https://crackingmarkets.substack.com/p/swing-mean-reversion-strategies-in

March 8, 2023 at 4:17 am #115494smurfki0808

ParticipantParticularly relevant given our chat yesterday Nick, thanks, S

-

AuthorPosts

- You must be logged in to reply to this topic.