Home › Forums › Trading System Mentor Course Community › Running Your Trading Business › Hedging A Stock Portfolio by Tom Basso

- This topic is empty.

-

AuthorPosts

-

October 16, 2018 at 4:17 am #101857

Nick Radge

KeymasterA worthy read:

October 16, 2018 at 4:38 am #109276Nick Radge

KeymasterJust been working through the numbers on this.

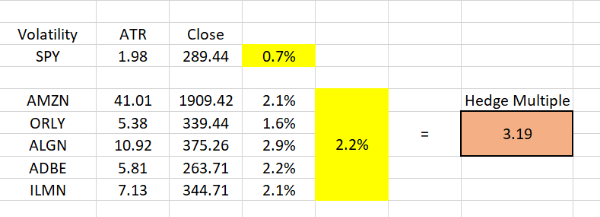

My DTVI (or Trade Long Term Premium Portfolio) has a volatility hedge multiple of 3.19, meaning 3x the dollar value of a $SPY position.

The hedge almost matches to the cent of losses this month.

October 16, 2018 at 6:07 am #109283

October 16, 2018 at 6:07 am #109283JulianCohen

ParticipantI’m not fully understanding where the 3.19 comes from.

October 16, 2018 at 7:02 am #109284Nick Radge

KeymasterIt’s saying that the Beta of the portfolio is 3.19x that of the SPY.

If your portfolio is worth $100,000 you need to short sell $319,000 worth of SPY to fully hedge the exposure.

October 16, 2018 at 8:07 pm #109285TimothyStrickland

MemberWow. I think I’ll go calculate the ones I have.

October 17, 2018 at 1:01 am #109277JulianCohen

ParticipantNick would you use futures or short the SPY?

October 17, 2018 at 1:24 am #109289Nick Radge

KeymasterFutures for sure. Just trying to work the beta out for the right amount of futures. I keep coming up short (no pun intended!)

October 17, 2018 at 3:41 am #109290JulianCohen

ParticipantI’m trying to work out how to actually set the stop entry. You can’t really use a stop as the market often bounces through the first Keltner Band and then closes above it, then carries on higher next day. If you use an MOC, which is possible, then you will miss a fair bit of the move on a big day like we just had last week.

I guess a hedge is really just a way of covering some of the losses, so it’s not so important to get an accurate beta hedge as by the time you get set, the market will have moved considerably.

October 17, 2018 at 6:34 am #109292Nick Radge

KeymasterThink of it a little differently…

What can you do to create less signals and capture larger moves when they come?

October 17, 2018 at 12:52 pm #109291LEONARDZIR

ParticipantWhat about options?

October 17, 2018 at 1:24 pm #109278RobGiles

MemberIn my experience trading physical wheat, if you’re long the underlying but want to reduce the negative effects if a material downside move occurs, then you have no choice but to a) reduce your position size, b) place a stop under the market to get yourself delta neutral (hedged) if the proverbial hits the fan or c) a bit of both. So if you’re want to be hedged on a large down move, you have to accept the fact that you could be stopped into the hedge and then the market could bounce. The whiplash could occur regardless where you put the stop.

Can someone explain what he means by the “faster moving Keltner band” and the “slower”? Is he saying he runs a stop at -1 x ATR and the balance at -2 x ATR?

October 17, 2018 at 9:07 pm #109295JulianCohen

ParticipantThe Fast moving K Band is 1.5X ATR and the Slow one is 2.5X ATR

October 18, 2018 at 9:03 pm #109279LEONARDZIR

ParticipantThere are a number of interesting articles on tail risk hedging by Mark Spitznagel on universa.net Apparently the best risk return model is long the stockmarket with 97% of your assets with 3% in “insurance” where the insurance product produces a “10 bagger” when the market falls greater than 15%. Some nice studies are noted but very few details on what you use for insurance. He is publishing a book in 2019 that sounds like it will provide details. Sounds really interesting to me.

October 18, 2018 at 9:09 pm #109298Nick Radge

KeymasterThat’s the old portfolio insurance using deep OTM puts.

We made a lot of money back in 2000/2001. We found a large fund manager had in its mandate to always buy deep OTM puts each quarter as insurance. They would buy 3 week puts in the SPI futures for 0.35 and 0.40 premiums. These had a delta of like 95 or more.

In what is now deemed complete madness, we’d sell hundreds – I think the largest position I had was short 700 puts. Complete and utter bankruptcy had we’d been wrong. Very egotistical and foolish.

October 20, 2018 at 2:08 pm #109294LEONARDZIR

ParticipantI researched Spitznagle’s strategy for hedging tail risk. Assuming a portfolio of 95-97% SPY at the end of each month you buy 0.5% of the portfolio value in 2 month OTM puts whose price is 30% below the SPY. At the end of each month you sell the puts and buy new 2 month puts. The breakeven occurs when the SPY goes down 20% If the spy goes down 20% this portfolio goes down 26%.If the SPY goes down 30% the portfolio loses 12.95% If the SPY goes down 40% the portfolio goes up 181%. I obtained these numbers from zerohedge.com.

No wonder Spitznagle has a multibillion dollar hedge fund since his portfolio skyrocketed in 2008. -

AuthorPosts

- You must be logged in to reply to this topic.