Home › Forums › Trading System Mentor Course Community › Progress Journal › Glen’s Journal

- This topic is empty.

-

AuthorPosts

-

May 6, 2018 at 6:31 am #101801

GlenPeake

ParticipantIt’s week 5 of my Mentor Course journey, everything is going well and am making good solid progress and trying to chip away at the course and work through the content on a daily basis. I’ve also listened to all of the available monthly calls that are in the archives (lots of good info in there).

I’m up to Section 3 – Module 20: Systematic Trading Styles and have enjoyed the course and glad I signed up.Prior to the course one, of my ‘challenges’ was trying to code an idea around a slightly different exit calculation with the Weekend Trend Trader. (I was not able to code this idea prior to the course).

My idea was:

When index filter is DOWN if stock close is >= 100% above entry price, then make trailing stop 20%

When index filter is DOWN if stock close is >= 0% and < 100% above entry price, then make trailing stop 10%

When index filter is DOWN if stock close is < than entry price, then make trailing stop 5% After completing Module 13 Looping, after a lot of tinkering and tweaking of the looping code I’ve been able to code the above idea. At this point I’ll put the modified exit code on hold and return to it once I’m deeper into the course theory and I’ve confirmed that my coding is accurate (appears to be working when eyeballing the charts etc). If nothing else, this was a a good exercise for understanding/learning the coding/looping better. Cheers

GlenMay 8, 2018 at 7:52 am #108605TrentRothall

ParticipantGood stuff Glen!

July 20, 2018 at 11:38 am #108606GlenPeake

ParticipantBit of an update on my progress….

I completed the theory part of the course last month and since then have been working on my first system.

I’m heading down the Mean Reversion MOC path atm.

I’ve been looking through the forum for ideas and other websites for ideas. I’ve found the Cesar Alvarez website and then Better System Cesar podcasts beneficial and a good starting point for ideas..

I’ve registered a PTY LTD trading entity via https://www.ecompanies.com.au/

I’ve subscribed to the Norgate Data offer/deal they had going for Beta Testers. Previously I was only subscribed to ASX data, now I have both US and AU data and converted my existing subscription over and am subscribed for the next 400 days.

I still need to sort out my IB Account and get that setup.

In terms of my MR MOC system, my idea is roughly based around a ‘day’s down’ system.

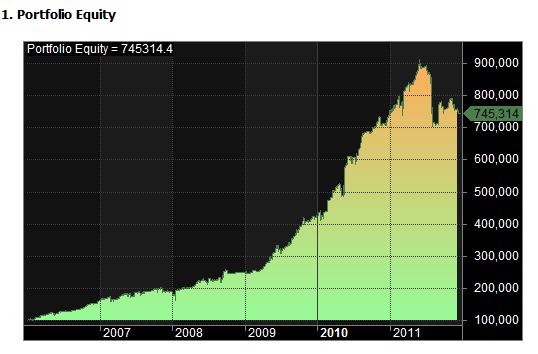

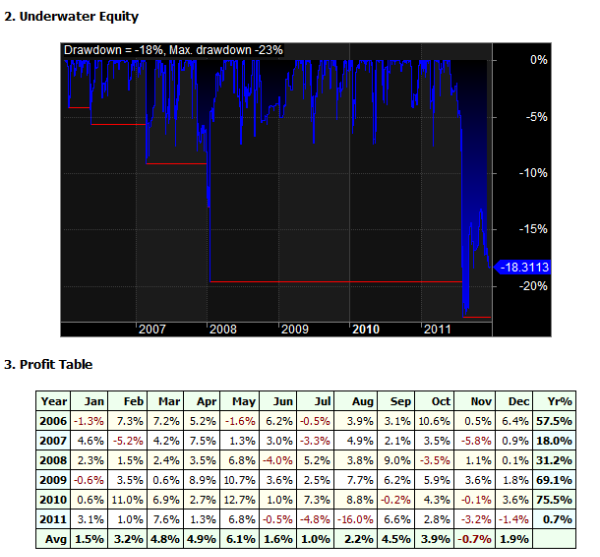

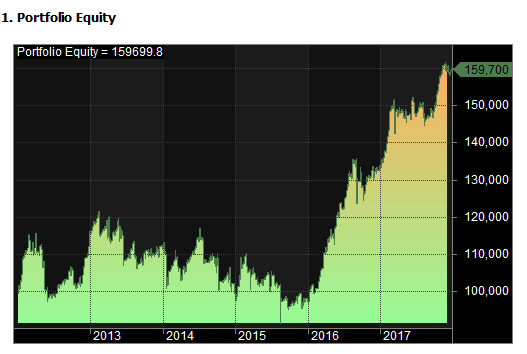

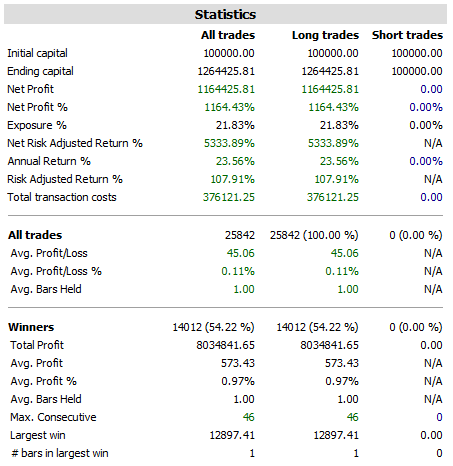

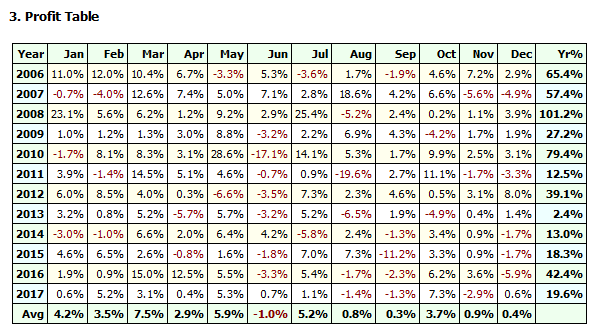

(This is version v0.36)Current work in progress stats for 1/1/2006 – 1/1/2012 (In Sample) on S&P500

July 20, 2018 at 11:41 am #108607

July 20, 2018 at 11:41 am #108607GlenPeake

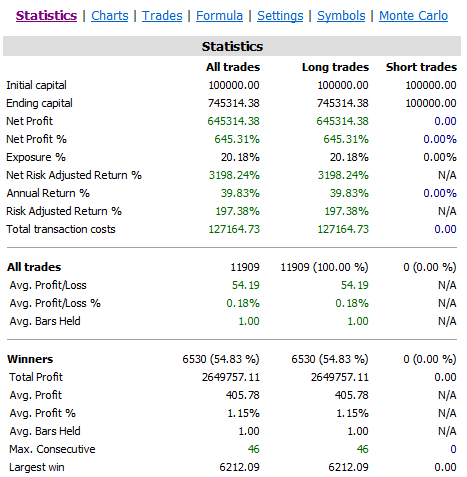

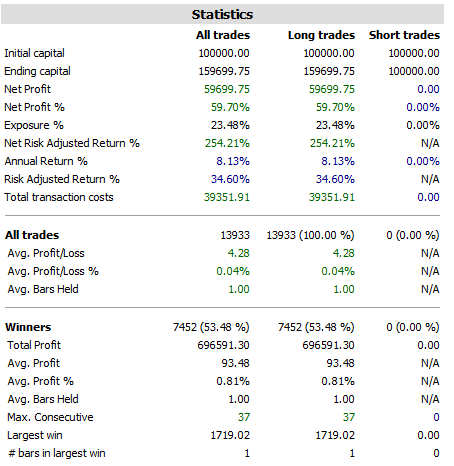

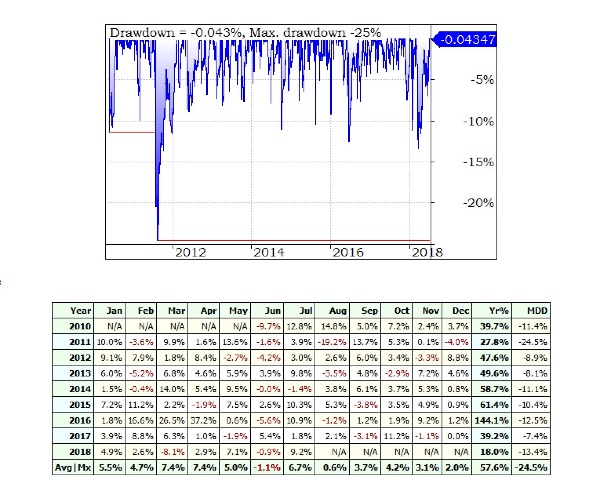

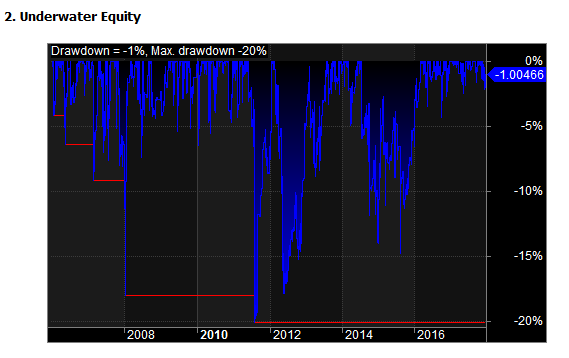

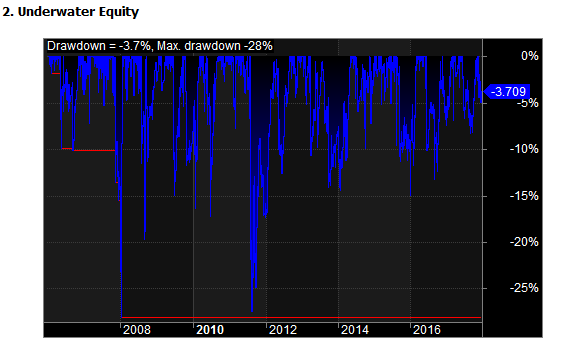

ParticipantMy Out Of Sample period, doesn’t look quite as nice: 1/1/2012 – 1/1/2018 on S&P500

July 20, 2018 at 11:43 am #108608

July 20, 2018 at 11:43 am #108608GlenPeake

ParticipantCombined IS and OOS 1/1/2006 – 1/1/2018 on S&P500

Just curious how other members MR MOC systems perform during the 1/1/2012 – 1/1/2018 period on the S&P500?

Thanks

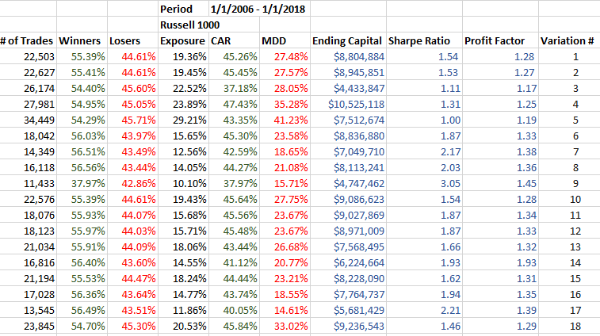

GlenJuly 21, 2018 at 12:53 am #108890JulianCohen

ParticipantHere’s mine, which is using the Russell 1000 as a universe.

So you have to try to work out what was different about the market in those three years that makes your system break down.

Actually comparing yours and mine month by month, and I haven’t done an exact comparison, just a glancing one, it looks like they are both going up in roughly the same months and down in roughly the same months, so it might be just a case of cutting back on the drawdowns.

Have you tried a set number of days as an exit, ie cut the position after five days if it hasn’t made a profit?

July 21, 2018 at 3:58 am #108891GlenPeake

ParticipantThanks for that Julian…. Some very nice numbers you have there..!!!

Yep…In terms of the market over that period, that was something that I had noticed….. The market just kept making Higher High Lower Lows etc….from 2012 to mid 2015…. etc…so possibly a lack of volatility is hurting the system…I might see how applying the VIX as a filter works out.

BTW… this system is only initiating/closing the position on the same day. I haven’t yet gone down the multi day hold MR ‘rabbit hole’ yet…. to see what difference that makes.

Cheers

GlenJuly 21, 2018 at 6:29 am #108894ScottMcNab

MemberAs a rough rule, the larger the ave proft/loss % the better of course but I would focus on raising that for the in-sample testing before going oos.. imho at the moment it is a bit skinny

July 21, 2018 at 3:29 pm #108895TimothyStrickland

MemberGreat stuff guys, lots of ideas. great numbers on both systems actually.

August 18, 2018 at 9:52 am #108609GlenPeake

ParticipantI’ve been working away on my MOC system and had been experimenting testing various ideas/options.

I managed to improve the performance of my system with the use of an index filter. Increase CAR, decrease MDD decrease exposure etc.

So although there’s improvements, the system doesn’t really fit the “perform pretty good most of the time” profile.

So, it was time to changed things up……

August 18, 2018 at 9:59 am #109005GlenPeake

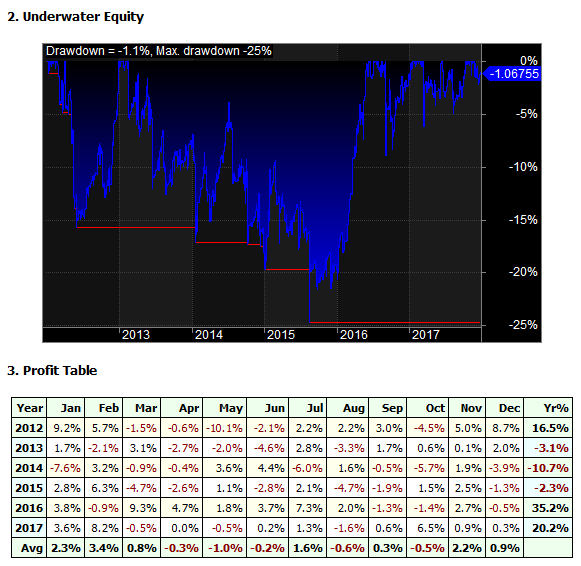

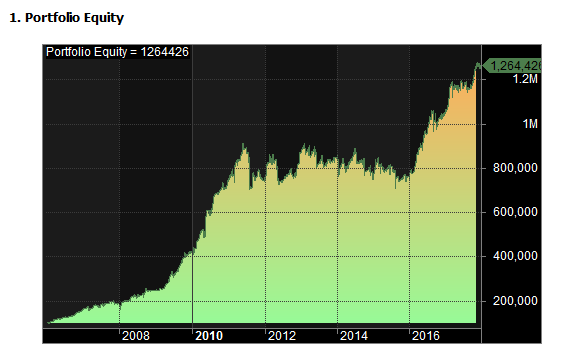

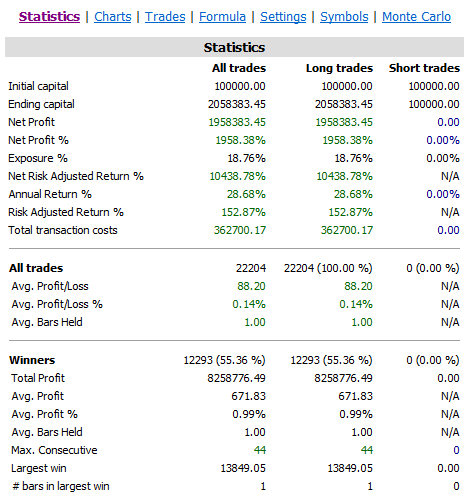

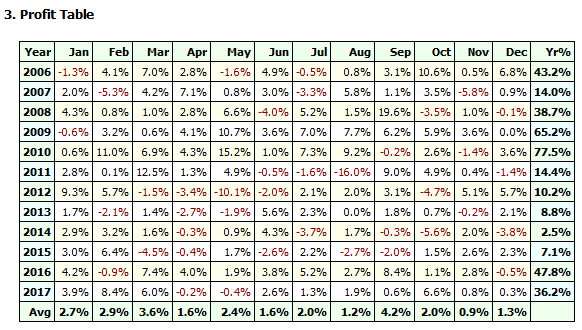

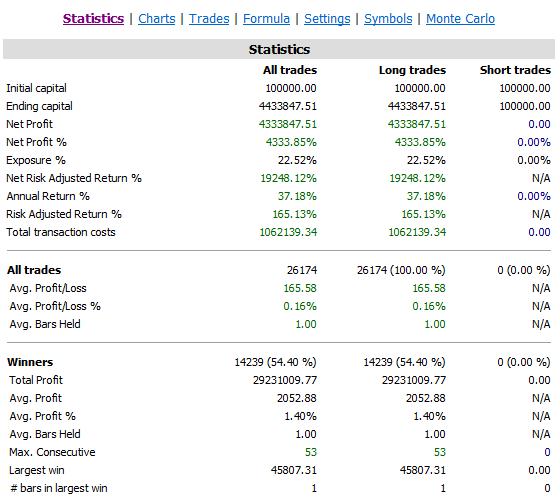

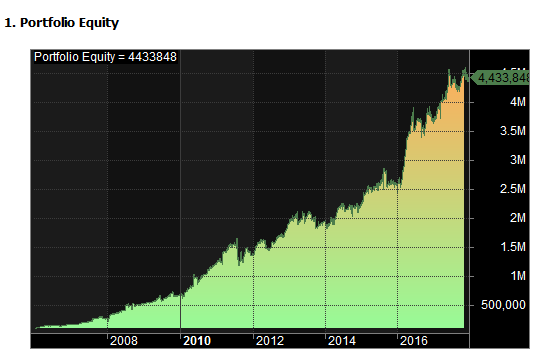

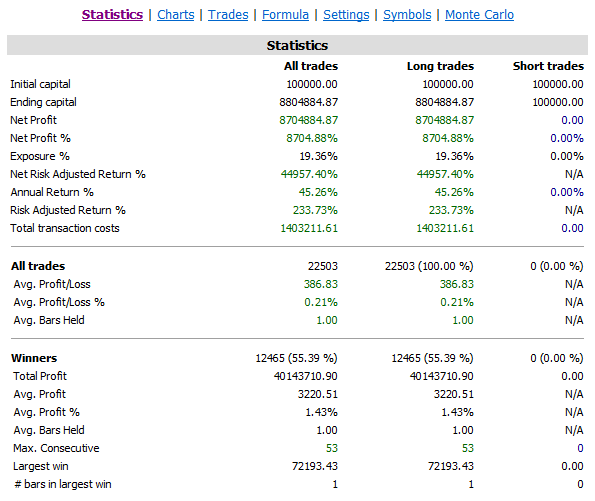

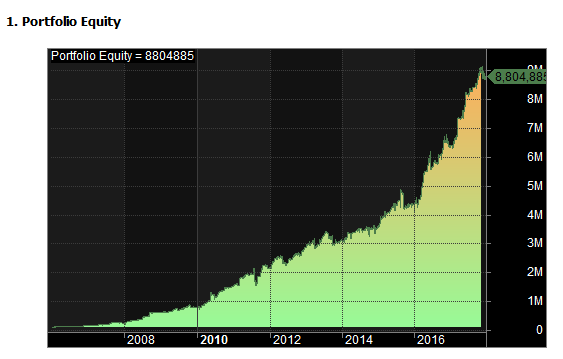

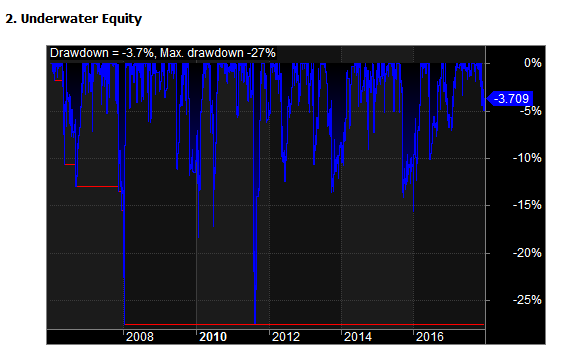

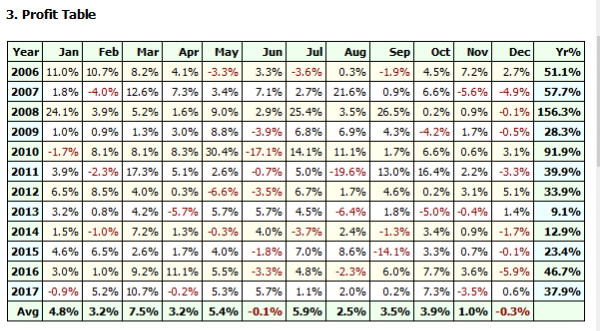

ParticipantSo with a new approach along with Nick’s assistance and guidance during the week…….This is what things are looking like atm….

August 18, 2018 at 10:07 am #109006

August 18, 2018 at 10:07 am #109006GlenPeake

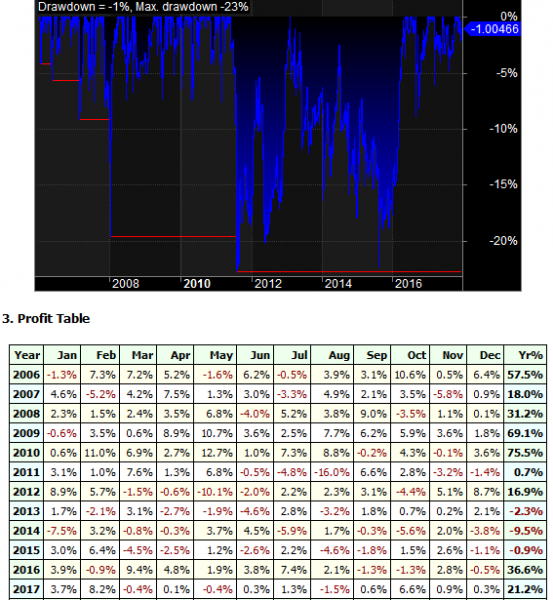

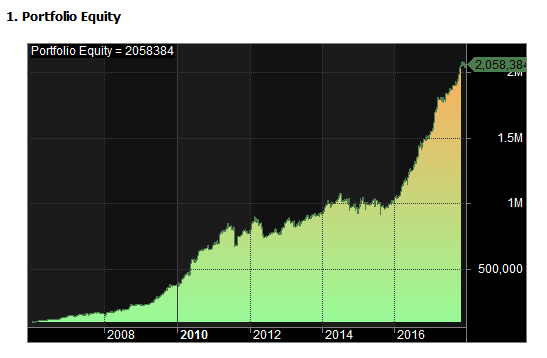

ParticipantWhen I apply the index filter that I had applied in my original/first system…..

So although my original/first system didn’t pass the ‘sniff’ test, I managed to find an option that has made a positive impact on this system.

August 18, 2018 at 10:14 am #109007GlenPeake

ParticipantCurrently testing different variations of this system, adjusting parameters to see “what works pretty good most of the time”

Cheers

GlenAugust 18, 2018 at 3:46 pm #109008TimothyStrickland

MemberThanks for sharing Glen, those are some impressive results on all fronts actually. I’m surprised you got so good returns in 2008 taking no short positions but I’m not done with the course yet either.

I am not sure I’d be willing to stomach a <+25% drawdown just yet so I'd have to take smaller position sizes with that strategy. It is nice to see what a system can be capable of.

August 19, 2018 at 3:02 pm #109009LEONARDZIR

ParticipantNice results. What does 2018 look like so far?

-

AuthorPosts

- You must be logged in to reply to this topic.