Home › Forums › Trading System Mentor Course Community › Running Your Trading Business › Share Trade Tracker

- This topic is empty.

-

AuthorPosts

-

June 22, 2016 at 7:51 am #101508

JulianCohen

ParticipantHow do I set STT to automatically apply the different brokerage charges between USD and AUD or do I have to have two spreadsheets, one for each currency?

June 22, 2016 at 8:31 am #104405Nick Radge

KeymasterI set the default to $1 then adjust manually on each trade.

Don’t use two different sheets.

June 22, 2016 at 8:43 am #104418JulianCohen

ParticipantNick Radge wrote:I set the default to $1 then adjust manually on each trade.Don’t use two different sheets.

OK thanks. I didn’t want to use two sheets so that’s a good solution

July 26, 2016 at 12:03 am #104406JulianCohen

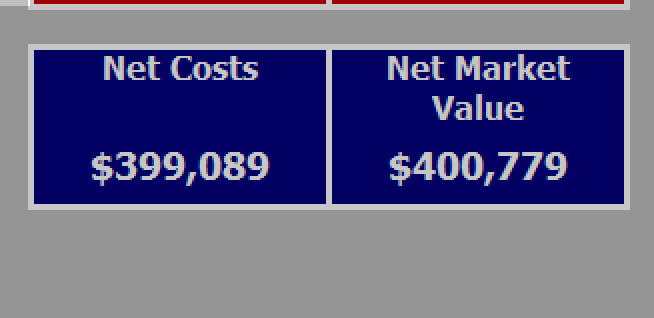

ParticipantIs STT going to show the total buys for every trade ad infinitum on the dashboard as Net Market Value or is mine doing something wrong. I am nett square but it is adding to the Net Market Value every day

July 26, 2016 at 5:23 am #104864

July 26, 2016 at 5:23 am #104864SaidBitar

MemberNet costs it represents all the positions that you bought accumulated together

Net Market Value it is the summation of all the closed positions and the open positionsand i believe no costs are included

July 26, 2016 at 6:10 am #104407Nick Radge

KeymasterThese are data points for tax purposes.

July 26, 2016 at 6:17 am #104865JulianCohen

ParticipantNick Radge wrote:These are data points for tax purposes.OK understood. It’s gonna get pretty high pretty quickly :unsure:

July 26, 2016 at 7:44 am #104866TrentRothall

ParticipantJulian Cohen wrote:Nick Radge wrote:These are data points for tax purposes.OK understood. It’s gonna get pretty high pretty quickly :unsure:

Makes you feel like a high roller though

August 4, 2016 at 10:27 pm #104408

August 4, 2016 at 10:27 pm #104408ScottMcNab

MemberApologies for another dumb question…..but how are people managing the different currencies in STT between the cash deposit (in AUD in my case) and the P/L based on share prices in USD ?

August 4, 2016 at 11:05 pm #104409ScottMcNab

MemberPlease ignore last post….just ran one of the financial reports and found that kept seperate

August 4, 2016 at 11:34 pm #104992JulianCohen

ParticipantI had exactly the same question :cheer:

Is there a ‘hack’ so the front page consolidates for currency conversion? I don’t mind if there isn’t but it would be kinda nice

August 4, 2016 at 11:50 pm #104410Nick Radge

KeymasterI keep all my portfolios separate and in their respective currencies. I don’t trade a USD portfolio with an AUD allocation – it’s a USD allocation to a USD portfolio and a AUD allocation to an AUD portfolio

August 5, 2016 at 12:38 am #104996JulianCohen

ParticipantNick Radge wrote:I keep all my portfolios separate and in their respective currencies. I don’t trade a USD portfolio with an AUD allocation – it’s a USD allocation to a USD portfolio and a AUD allocation to an AUD portfolioI was planning on a lump sum in USD with the US same day exit MR and ASX running off it. I would adjust the amount available to the US strategy each night dependant on the position held and equity amount of the AUD one. I can manage the currencies myself and will probably just set a nominal amount for each strategy. If the total available to trade is 100 I will just set each strategy to 50 in STT. Does that seem a good way to go about things?

August 5, 2016 at 1:13 am #104411ScottMcNab

MemberWhy not trade both US and ASX with the same day system (MOC) and allocate 100% to each ?

August 5, 2016 at 1:25 am #104997JulianCohen

ParticipantScott McNab wrote:Why not trade both US and ASX with the same day system (MOC) and allocate 100% to each ?So far I have better results from a regular MR system on the ASX. I agree your idea would be better so I’ll do some more testing.

-

AuthorPosts

- You must be logged in to reply to this topic.