When trading the HFT I occasionally noticed an execution in the Exploration that I didn’t get in the real account. I always need to understand why a signal is generated or missed.

In most instances it appeared that the official trading range included pre-market trading and because my account was configured to the main session only I may miss some of these fills. This seemed to be more important during earnings season because most of the time a company releases its earnings outside of market hours and the volatility is mainly seen pre market.

So I reconfigured my account so that entries participated in the pre market. On occasion I still missed some fills and when I questioned IB and reviewed Time & Sales it appeared that SMART didn’t send my order because the traded volume was minuscule.

Last night I had a different ‘weird’ one.

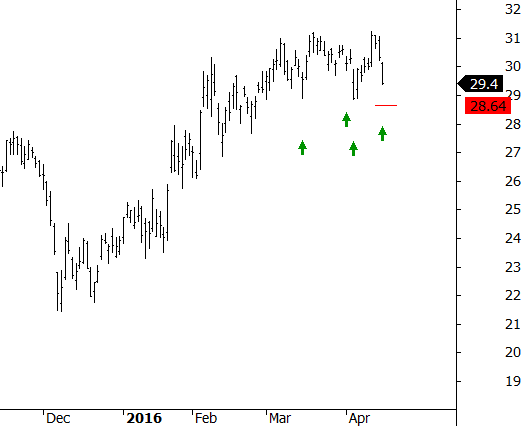

SE was a buy at $28.64 (refer red line on the chart below)

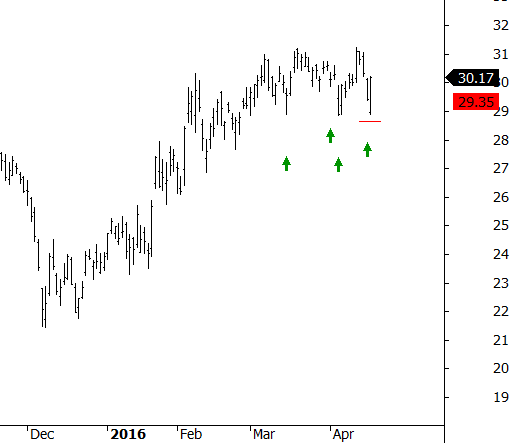

Earnings came out and the stock gapped down and the traded higher. Here’s how the chart looks:

As can be seen the low of the day didn’t tag the buy price – yet I got a fill way down there. Nice!

So my point is that trading and testing is not an exact science. There will always be small aberrations and so long as those aberrations remain small then there is no need to be concerned. Obviously with these Mean Reversion systems that take frequent small bits of the cake is less of a worry. A trend following strategy that is more reliant on big trends would be more of a concern.

.