Home › Forums › Trading System Mentor Course Community › AmiBroker and Data Setup › Backtester Settings

- This topic is empty.

-

AuthorPosts

-

March 2, 2016 at 6:53 am #101420

TrentRothall

ParticipantI think i might have missed a trick here…. Should this be set to 0? I noticed because the ‘Position Value’ of the trades were different once the account got huge with compounding in the backtests. I am thinking it should be 0 because you are never going to trade with a $20m account so the positions wouldn’t be that huge…..

March 2, 2016 at 8:10 am #102897SaidBitar

MemberI think it should not be ZERO due to the fact that you want to make your backtest as realistic as possible. so in my opinion even 10% is a bit huge you can drop it down to 3 or 5%.

March 2, 2016 at 8:29 am #102898TrentRothall

ParticipantYeah ok i see what you mean. I could understand it if you were looking at net profit as the main performance metric but if you are looking at CAR as a % then wouldn’t the positions need to be constant?

March 2, 2016 at 8:37 am #102905SaidBitar

MemberHere is my understanding:

you bought one stock with 5% of your equity and the price went to 100% over certain period so you made 5% profit on equity level.

but if your 5% of the equity represents large percentage of daily turnover then in reality you would not have purchased with 5% maybe it would have been 3% or what ever seems ok and in this case the total profit is 3% on equity level.the profit side of it is not the important part but the drawdown is the one that makes the difference.

just you can run backtest with multiple values and compare I imagine the only difference will be lower drawdowns

March 2, 2016 at 9:19 am #102899TrentRothall

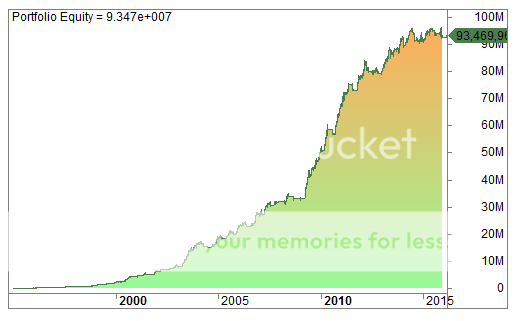

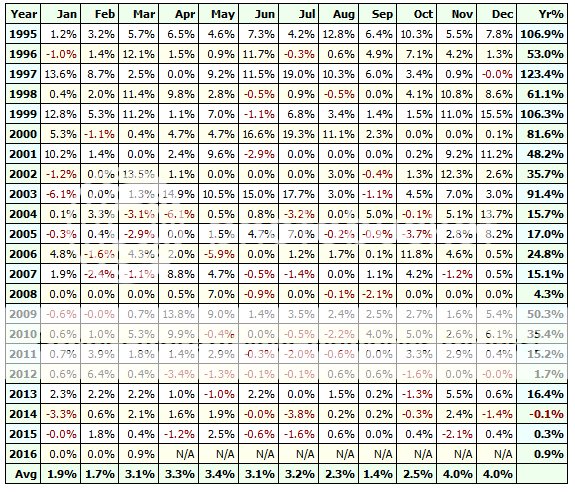

Participantthis is with the value at 10%

This is at 0% – i feel this drawdown is more accurate

If a position moves -10% but you only have 7.5% of equity instead of 10% then you still lose 10% of that position – but it will be a smaller % of total equity. Hence smaller drawdowns when the cap is set at 10% vice versa for gains i guess. CAR increases about 5% in this second test

March 2, 2016 at 9:47 am #102900TrentRothall

ParticipantNot sure why the pictures didn’t work properly..

Anyway at 0% some of the drawdowns are a bit deeper and CAR is 5% higher

March 2, 2016 at 6:09 pm #102908SaidBitar

Memberthis is what i was talking about

anyhow you can put zero if you want will not make huge difference as long as liquidity is OK

March 2, 2016 at 7:19 pm #102909Nick Radge

KeymasterTrent,

You have ‘attached’ those images rather than inserting them. Edit the post and use insert.March 2, 2016 at 11:55 pm #102901TrentRothall

ParticipantThanks Said i will keep testing.

Nick what setting do you recommend?

March 4, 2016 at 7:53 am #102902TrentRothall

ParticipantFinally worked out why I stuffed the inserts up on the previous page – seems to be that I had a ‘%’ symbol in the name it didn’t like tthat. I think I might have them attached a the start too like Nick said

March 4, 2016 at 8:16 am #102919SaidBitar

Memberhehehe

yeah it doesn’t like % because somehow it is reserved character for example %d is space and so on

March 4, 2016 at 8:44 am #102903TrentRothall

ParticipantOh ok, yeah right it only took me a few hours to sort out haha

March 11, 2016 at 6:04 pm #102920SaidBitar

MemberI think now i have answer for two questions at the same time

so i tested the same strategy with two different settings

First time with the position size not to exceed 3% of the previous bar volume

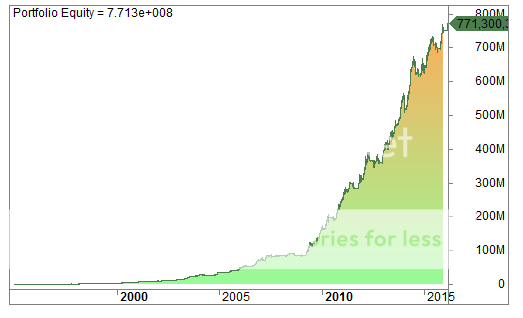

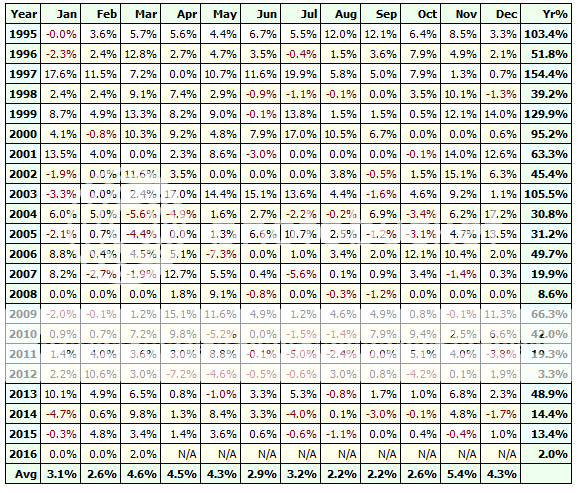

Second with the settings set to ZERO this means don’t care about the previous bar volumehere are the results

first 3%

here are the results with ZERO (no limitations)

March 11, 2016 at 6:16 pm #102992

March 11, 2016 at 6:16 pm #102992SaidBitar

MemberAs you can see with the 3% the equity curve became flat because it requires lots of profits to generate respectful percentage of the portfolio and also the monthly returns started to decrease with time from double digit per year to one digit and some losing years.

while in the case of no restrictions you notice that the equity curve will continue to shoot up exponentially and the annual returns are still high.

Which one is correct i do not know maybe both but what is for sure with limitation it gives better realistic vision of the returns in case (which is not true) that we started trading this system back in 1995. while without limitation it give clear idea about the returns it produced every month/ year but again i think this is the job of the rolling windows that is discussed in the course.

so the second question that is answered (which i asked and i was wondering about) is why annual returns degrade with time and now i know why because of the limitations of 3% that i set in amibroker

one thing i noticed now that system has not only minimum limitation when it comes to capital but also it has maximum capital that after this number it is not as profitable. Sure thing i will not be even sad if i reach this stage but still good to know

-

AuthorPosts

- You must be logged in to reply to this topic.