Home › Forums › Trading System Mentor Course Community › Progress Journal › Said Bitar Daily Journal

- This topic is empty.

-

AuthorPosts

-

January 24, 2016 at 2:57 pm #101406

SaidBitar

MemberSunday 24/1

TO DO

[ol]

[li]Finish Module 24[/li]

[li]Try to code the entry of breakout system with two parts of the position 25% and 75%[/li]

[li]Try to add code to the position sizing to check the position value with the daily turnover of the stock to be sure that the system is realistic[/li][/ol]

Pending:

[ol]

[li]Task: Entry Mind Map[/li]

[li]Reading the newly added documents on Trading System Article Depository[/li]

[/ol]January 26, 2016 at 9:06 pm #102524SaidBitar

MemberMonday 25/1

was bad day work and after work not much was done

Tuesday 26/1

[ol]

[li]Finished Module 25 (Very good module lots of new ideas and stuff that never imagined exits )[/li]

)[/li]

[li]Verified the Entry and position size for scale in[/li][/ol]

January 27, 2016 at 9:24 pm #102594SaidBitar

MemberWed 27/1

Finished Mod 26 lots of new information that needs lots of time to test. Over the weekend have to re read several modules again to digest their rich contents.

new idea that sounds very interesting :

“Exposure % – ‘Market exposure of the trading system calculated on bar by bar basis. Sum of bar exposures divided by number of bars. Single bar exposure is the value of open positions divided by portfolio equity. In layman terms exposure means how much time you’re invested in the market. Buy and hold would be 100 and 10 would mean you’re invested just 10% of the time. This can be beneficial to discern how much capital is being used with the strategy and therefore offers an insight on the ability of using the same capital to trade other strategies. “interesting stuff especially when there is a trading system with 35% exposure time.

January 27, 2016 at 9:32 pm #102599Nick Radge

KeymasterQuote:interesting stuff especially when there is a trading system with 35% exposure time.Yes. Some of my mean reversion systems have very low exposure, i.e. < 15%.

However, many signals are clustered so sometimes (like in the current environment) I’m not seeing much action. However, in other environments I may go 150% invested.One of my goals for 2016 is to work my capital harder at all times – meaning developing other systems that take up the slack when capital is available (like now).

January 28, 2016 at 8:46 pm #102600SaidBitar

MemberI have to make more detailed testing to know exactly under what conditions the system was on and then start looking for ideas to fill the idle time.

the nice thing with the idea is that the same money will be used for two systems which is great but also i should test the results together to see the drawdowns and the other effects

January 28, 2016 at 8:54 pm #102608SaidBitar

MemberThursday 28/1

All theoretical part is done, till the end of the week i should re check some of them since some ideas are new and require some time to digest

Hopefully next week system developing will start, last module is so rich with ideas.

28/1 days run very fast and almost one months of 2016 and the only trading i did was closing some trades that hit the trailing stop just one survivor actually it is only moving in its place one day up next day down

February 1, 2016 at 7:52 pm #102609SaidBitar

MemberFriday 29/1 till Sunday 31/1

nothing special just re reading some of the modules

Ran MCs on two strategies

tried to improve one trend following strategyMonday 1/2

i ran backtest on Trend Following strategy and other MRV strategy and took the VAMI (profit table) from amibroker for each strategy and summed them together.

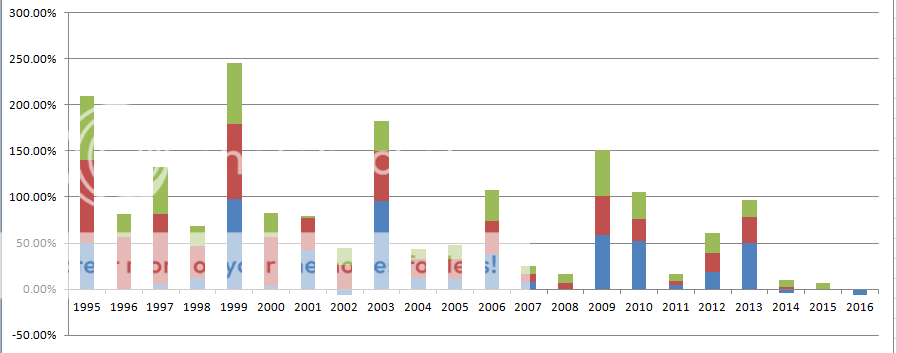

the blue is trend following and the others are MRV. when i saw how the multiple strategies compliment each other and improve the over all performance of trading I dumped the idea of seeking the best results by changing the entries and exits for the Trend following strategy.

Note for myself:

Time and following the system pays on the long run.

Hmmm time is an enemy and friend at the same time February 1, 2016 at 9:05 pm #102737

February 1, 2016 at 9:05 pm #102737Nick Radge

KeymasterGreat work Said.

How’s the correlation look on the systems – especially the two MR systems?

February 1, 2016 at 9:13 pm #102738SaidBitar

MemberTough question

i think the correlation is a bit high, since the same concept and same universe.

i have to test it

February 1, 2016 at 9:21 pm #102525Nick Radge

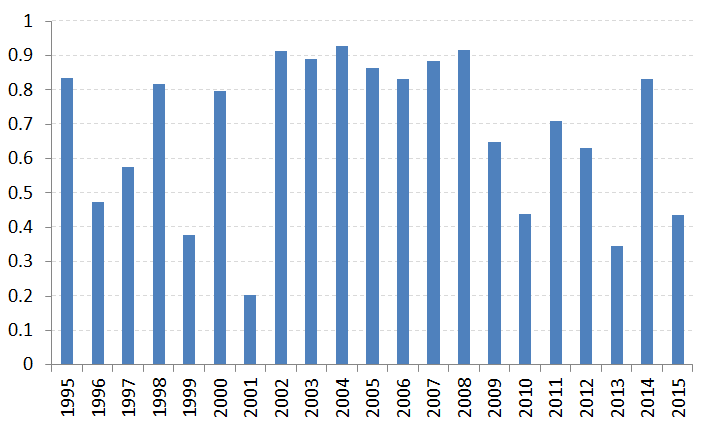

KeymasterHere’s the correlation between the two MR systems.

February 1, 2016 at 10:06 pm #102739

February 1, 2016 at 10:06 pm #102739SaidBitar

Memberthis is the monthly returns.

i was expecting to have high correlation between them.

February 2, 2016 at 9:18 am #102740SaidBitar

MemberI calculated the correlation coef based on monthly return for the period from 1/1/1995 till 1/1/2016 for the two MRV systems and it is 0.69

February 2, 2016 at 9:27 pm #102741SaidBitar

MemberTuesday 2/2

Tested the system in Trading System Article Depository.

started coding a new system

watching football and coding don’t work together 😳February 3, 2016 at 9:07 pm #102745SaidBitar

MemberWED 3/2

fine tuned the momentum strategy

February 4, 2016 at 9:37 pm #102762SaidBitar

MemberThursday 4/2/2016

Testing some ideas for swing trading. No good results yet actually all results were bad

Ideas are everywhere but when they are put to test few surviveregarding trading still all my index filters are down so no new trades. Holding one trade (OCLR) since 23/11/2015 in the last 3 days it went up more than 25%

-

AuthorPosts

- You must be logged in to reply to this topic.