Home › Forums › Trading System Mentor Course Community › Trading System Brainstorming › Position Sizing and money management

- This topic is empty.

-

AuthorPosts

-

January 21, 2016 at 8:07 pm #101398

SaidBitar

MemberFew questions regarding Position Sizing and Money management in Module 23 and money management in general.

1- I noticed during the exercise for Amibroker regarding the settings one that was related to allow position size to shrink it was set to False. Normally I shrink the position size especially after having some losses there will not be enough capital for a full position. Assume that you have 100K capital and the plan is 20 positions 5% each. so assume we buy the first 10 positions for 5K $ each and then we had to sell 5 of them with 500$ loss, so the money in cash will be 72,500$ and 25,000$ are in the market so the next position will be according to my understanding is 97,500/20 = 4875$ and not 5000$. In this case in order for the simulations to be synchronized with the real practice that i do Should I enable allow position size to shrink?

2- Regarding Maximization of the profit.

while dividing the capital into two parts IC conservative and RP aggressive

so it will be looking something like this

January 21, 2016 at 8:14 pm #102429

January 21, 2016 at 8:14 pm #102429SaidBitar

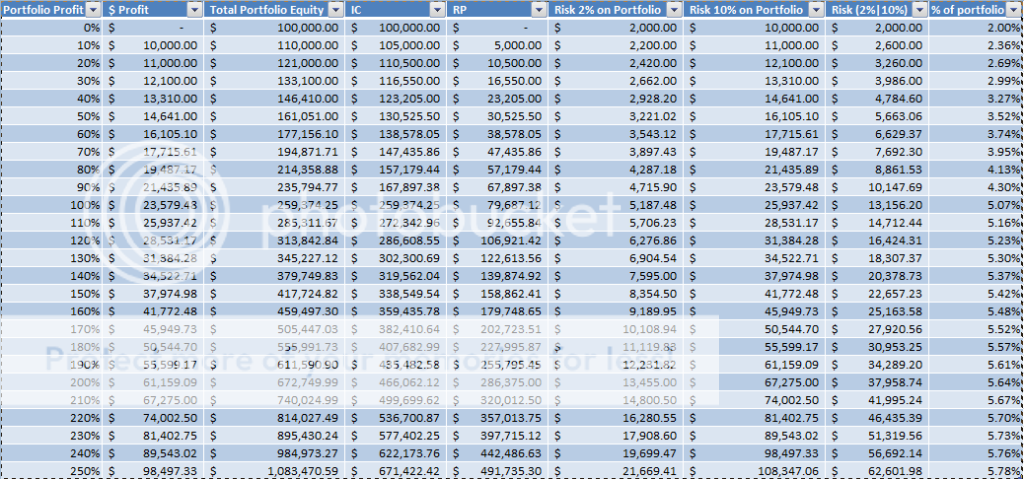

Memberjust to clarify the table

first col is the profit of increment of 10%, second is the profit value in $, col 3 new equity value, col 4 IC equity, col 5 RP equity, col 6 how much is risking only 2% of the portfolio, col 7 how much is risking 10% of the portfolio looks like ( the aim is to compare the $ value between 2%, 10% and the mixed solution), col 8 how much is the risk for the solution using 2% of IC and 10% of RP, last col is the % at risk in total (2% with the 10%)can this be coded with AFL ??

what will happen in case of drawdown money is moved from one to another or balancing is only with the increment of the portfolio equity

January 21, 2016 at 10:43 pm #102431Stephen James

MemberIn regard to the coding parts of your query,

The Position Shrinking option allows a partial position to be taken if there is not enough capital for a full position.

You would have to run separate tests for different % of risk and/or different position sizing methods

January 21, 2016 at 10:51 pm #102432Nick Radge

KeymasterI doubt this could be coded into AB.

I would suggest that take the conservative route as a benchmark and move along from there.The other important things is to recognise that compounding or more advanced position sizing takes time to show itself and usually the time factor (aka patience) is the great undoing of most new traders. It’s all a mute exercise if one can’t apply a strategy for any extended length of time.

June 20, 2016 at 7:55 am #102430TrentRothall

ParticipantHas anyone tested shrinking positions based on x% DD. I know in a pod cast Jerry Parker i think talks about shrinking position size by x% once DD hits 5,10,15%

Wondering if anyone has coded anything like this?

Once DD hits 10% reduce positions to 7.5% of portfolio instad of 10 or something like that. Or even test the opposite ramping up positions to get out of DD quicker, I know one guy who does this but its a discretionary call i think – don’t really know how it works out for him either. :S

My understanding is the equity() function is only for single instrument systems??

June 20, 2016 at 8:49 am #104384ScottMcNab

ParticipantTrent Rothall wrote:Or even test the opposite ramping up positions to get out of DD quicker, I know one guy who does this but its a discretionary call i think – don’t really know how it works out for him either. :SIs that tending towards a Martingale type strategy ?

June 20, 2016 at 8:50 am #104385SaidBitar

Memberwhat i know that you need the custom backtester for this, and here is the problem that there is no help or even guide for this.

i imagine that it should be like this

Code:SetOption(“UseCustomBacktestProc”, True );

SetCustomBacktestProc( “” );if ( Status( “action” ) == actionPortfolio )

{

bo = GetBacktesterObject();

bo.Backtest();

st = bo.GetPerformanceStats( 0 );

DD = st.getvalue(“MaxSystemDrawdownPercent”);

for(bar=0; bar< BarCount;bar++) { bo.ProcessTradeSignals(bar); curEquity = bo.Equity; if( DD >= 10)

{

SetPositionSize(1000,spsShares);

//PositionSize = -10;

}

else

{

SetPositionSize(500,spsShares);

//PositionSize = -7.5;

}}

}

I tested and it is NOT working

no idea where is the mistake but it is one thing that you can start and experiment onJune 20, 2016 at 9:31 am #104387

no idea where is the mistake but it is one thing that you can start and experiment onJune 20, 2016 at 9:31 am #104387TrentRothall

ParticipantThanks Said i will hve a play around.

Scott – i am not 100% sure i just think h takes bigger positions sometimes, personally i think he is pretty risk averse maybe too much but i don’t know much about his sizing.

i imagine it wouldn’t be the best practice ramping up positions during DD

June 20, 2016 at 10:30 am #104386SaidBitar

Member

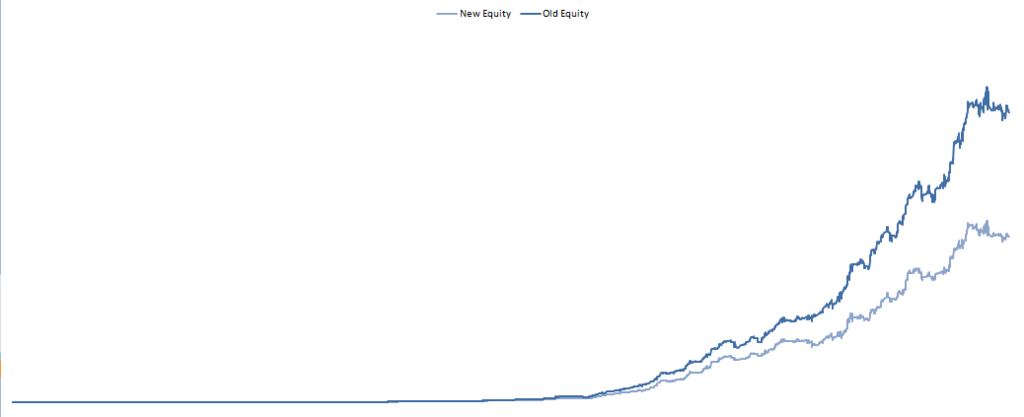

Ok so i checked in Excel the following criteria:

1- if the DD <= -15% then reduce to quarter the Position size

2- if the DD <= -10% the reduce to half the position size

and increase the same portion on the way upso as per my testing there is no added value, which is somehow expected since with smaller positions you need more time to come out of DD.

June 20, 2016 at 12:14 pm #104388SaidBitar

Memberhere is the excel file

just add the result from Backtest in Raw Data sheet and put the values you want in the controls sheet and it will generate the graph before and after

June 21, 2016 at 9:14 am #104389TrentRothall

ParticipantThanks once again Said

-

AuthorPosts

- You must be logged in to reply to this topic.